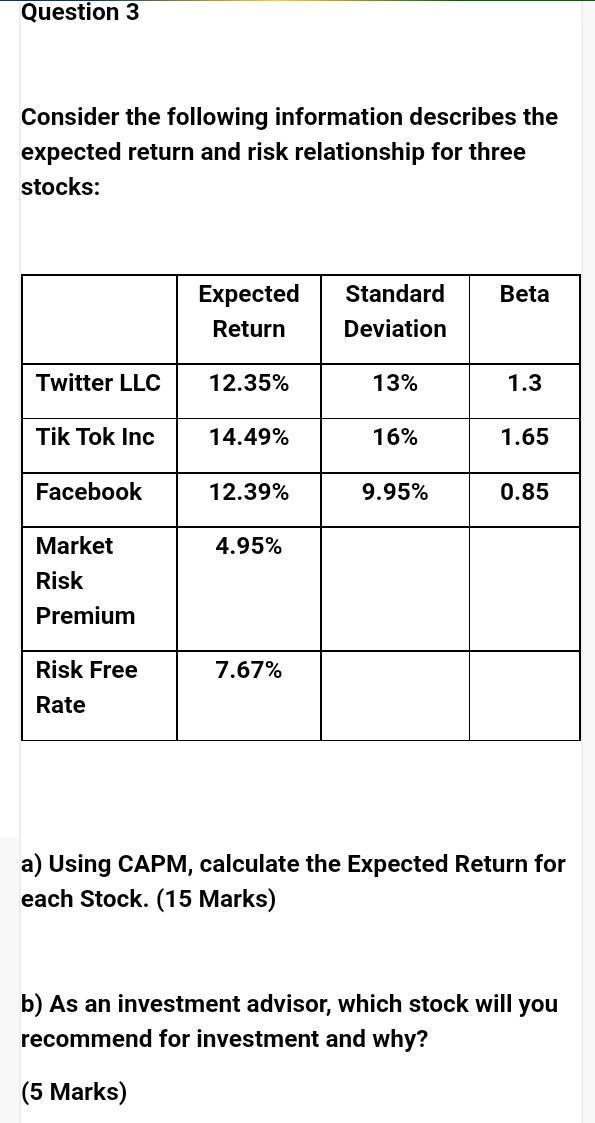

Question: Question 3 Consider the following information describes the expected return and risk relationship for three stocks: Beta Expected Return Standard Deviation Twitter LLC 12.35% 13%

Question 3 Consider the following information describes the expected return and risk relationship for three stocks: Beta Expected Return Standard Deviation Twitter LLC 12.35% 13% 1.3 Tik Tok Inc 14.49% 16% 1.65 Facebook 12.39% 9.95% 0.85 4.95% Market Risk Premium Risk Free 7.67% Rate a) Using CAPM, calculate the Expected Return for each Stock. (15 Marks) b) As an investment advisor, which stock will you recommend for investment and why

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts