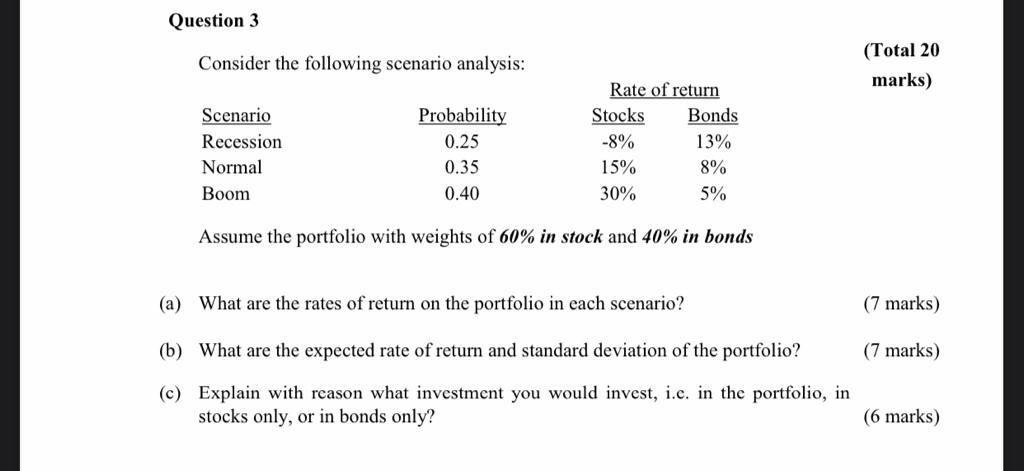

Question: Question 3 Consider the following scenario analysis: (Total 20 marks) Scenario Recession Normal Boom Probability 0.25 0.35 0.40 Rate of return Stocks Bonds -8% 13%

Question 3 Consider the following scenario analysis: (Total 20 marks) Scenario Recession Normal Boom Probability 0.25 0.35 0.40 Rate of return Stocks Bonds -8% 13% 15% 8% 30% 5% Assume the portfolio with weights of 60% in stock and 40% in bonds (a) What are the rates of return on the portfolio in each scenario? (7 marks) (b) What are the expected rate of return and standard deviation of the portfolio? (7 marks) (c) Explain with reason what investment you would invest, i.c. in the portfolio, in stocks only, or in bonds only? (6 marks)

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock