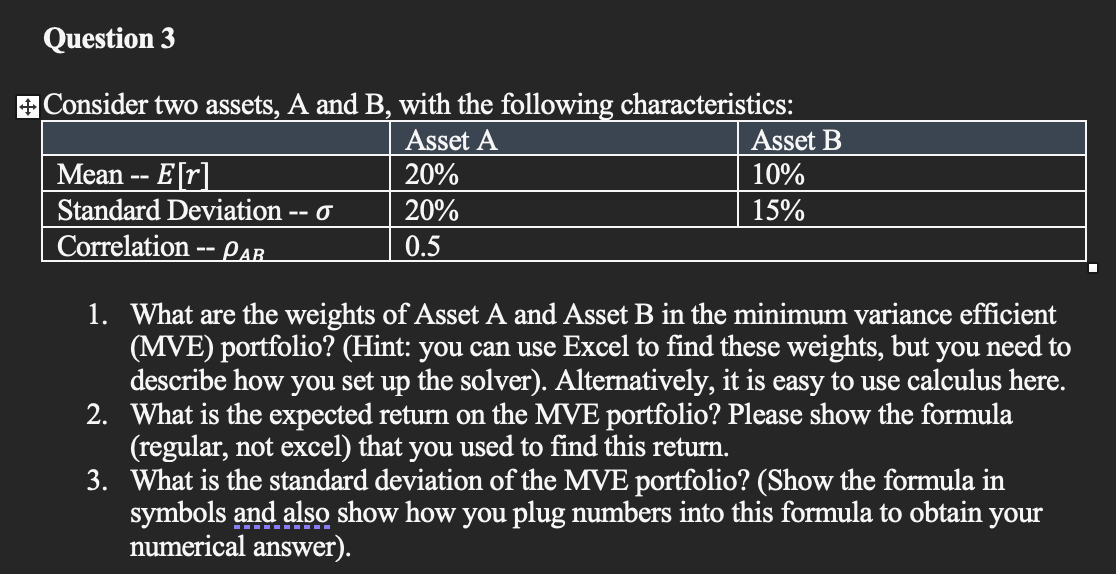

Question: Question 3 + Consider two assets, A and B, with the following characteristics: Asset A Asset B Mean -- E[r] 20% 10% Standard Deviation --

Question 3 + Consider two assets, A and B, with the following characteristics: Asset A Asset B Mean -- E[r] 20% 10% Standard Deviation -- 0 20% 15% Correlation -- Pas 0.5 1. What are the weights of Asset A and Asset B in the minimum variance efficient (MVE) portfolio? (Hint: you can use Excel to find these weights, but you need to describe how you set up the solver). Alternatively, it is easy to use calculus here. 2. What is the expected return on the MVE portfolio? Please show the formula (regular, not excel) that you used to find this return. 3. What is the standard deviation of the MVE portfolio? (Show the formula in symbols and also show how you plug numbers into this formula to obtain your numerical answer)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts