Question: Question # 3 Consideration On January 1 , 2 0 1 7 , Hogwarts Co . entered into a seven year lease for a Hungarian

Question # Consideration

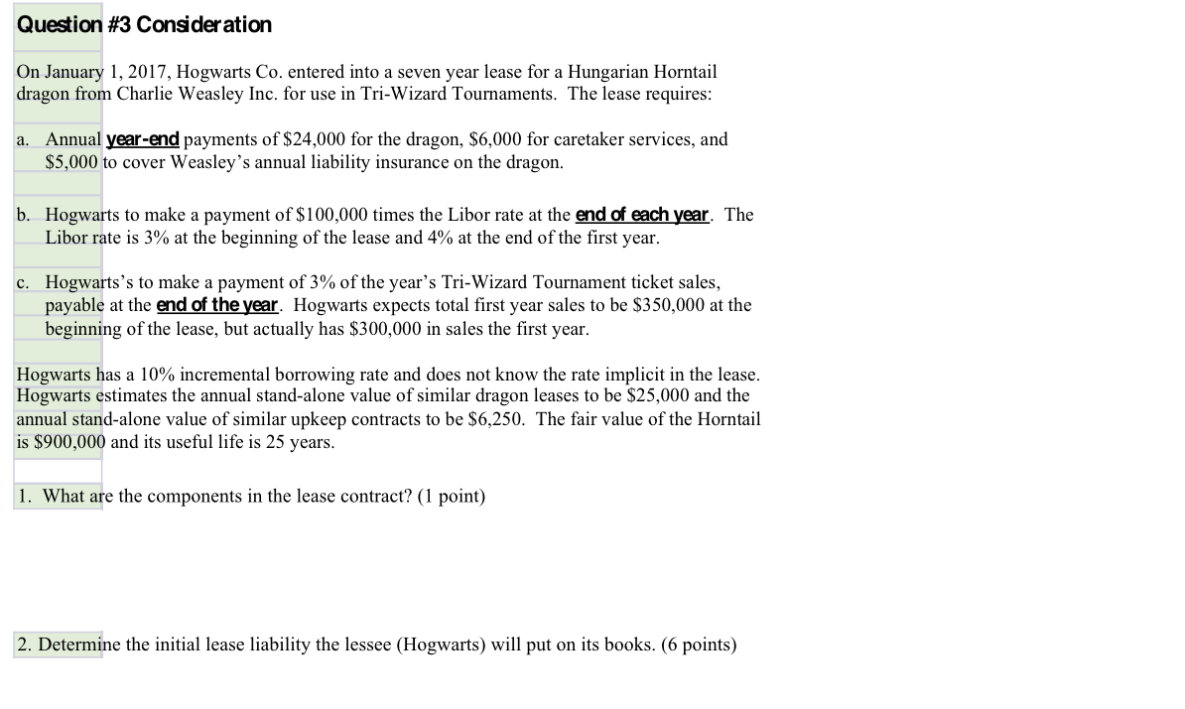

On January Hogwarts Co entered into a seven year lease for a Hungarian Horntail dragon from Charlie Weasley Inc. for use in TriWizard Tournaments. The lease requires:

a Annual yearend payments of $ for the dragon, $ for caretaker services, and $ to cover Weasley's annual liability insurance on the dragon.

b Hogwarts to make a payment of $ times the Libor rate at the end each year. The Libor rate is at the beginning of the lease and at the end of the first year.

c Hogwarts's to make a payment of of the year's TriWizard Tournament ticket sales, payable at the end of the year. Hogwarts expects total first year sales to be $ at the beginning of the lease, but actually has $ in sales the first year.

Hogwarts has a incremental borrowing rate and does not know the rate implicit in the lease. Hogwarts estimates the annual standalone value of similar dragon leases to be $ and the annual standalone value of similar upkeep contracts to be $ The fair value of the Horntail is $ and its useful life is years.

What are the components in the lease contract? point

Determine the initial lease liability the lessee Hogwarts will put on its books. points

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock