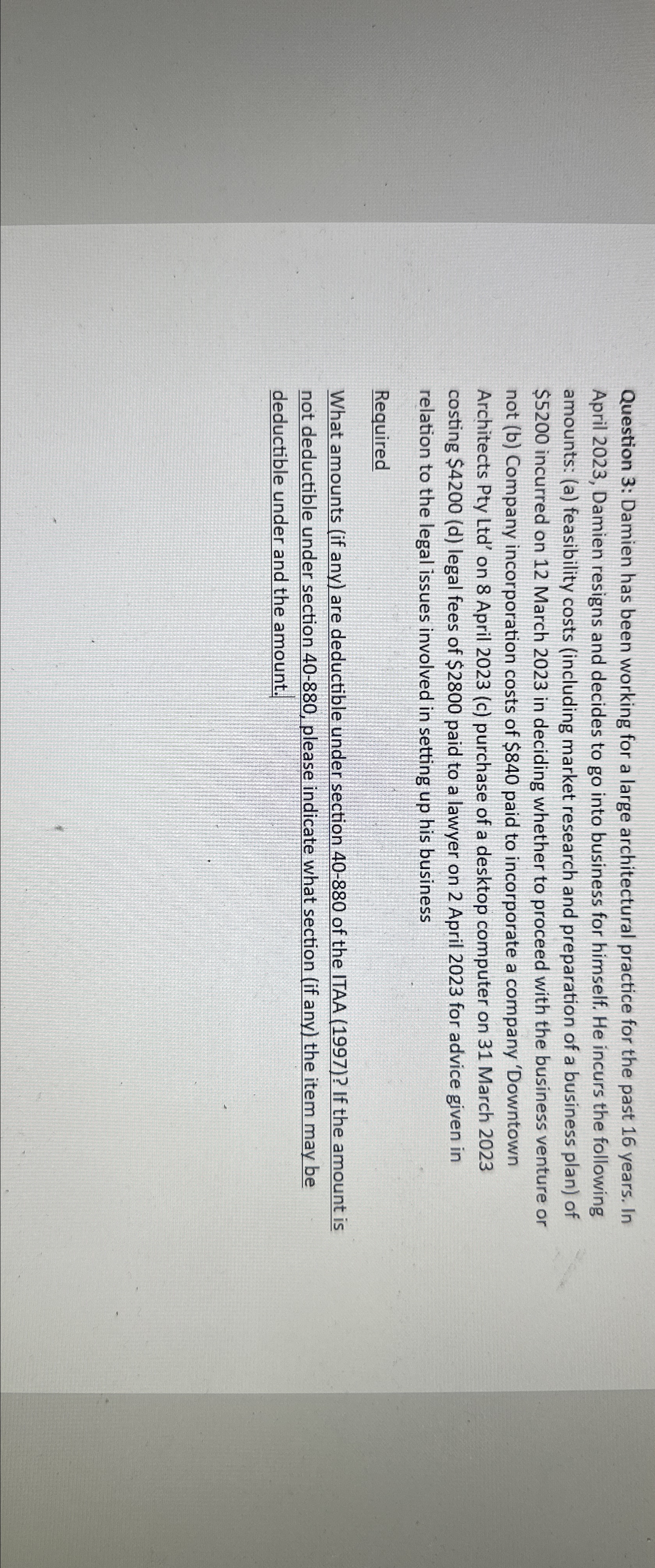

Question: Question 3 : Damien has been working for a large architectural practice for the past 1 6 years. In April 2 0 2 3 ,

Question : Damien has been working for a large architectural practice for the past years. In April Damien resigns and decides to go into business for himself. He incurs the following amounts: a feasibility costs including market research and preparation of a business plan of $ incurred on March in deciding whether to proceed with the business venture or not b Company incorporation costs of $ paid to incorporate a company 'Downtown Architects Pty Ltd on April c purchase of a desktop computer on March costing $d legal fees of $ paid to a lawyer on April for advice given in relation to the legal issues involved in setting up his business

Required

What amounts if any are deductible under section of the ITAA If the amount is not deductible under section please indicate what section if any the item may be deductible under and the amount.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock