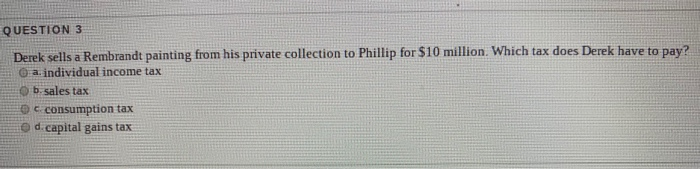

Question: QUESTION 3 Derek sells a Rembrandt painting from his private collection to Phillip for $10 million. Which tax does Derek have to pay? O a

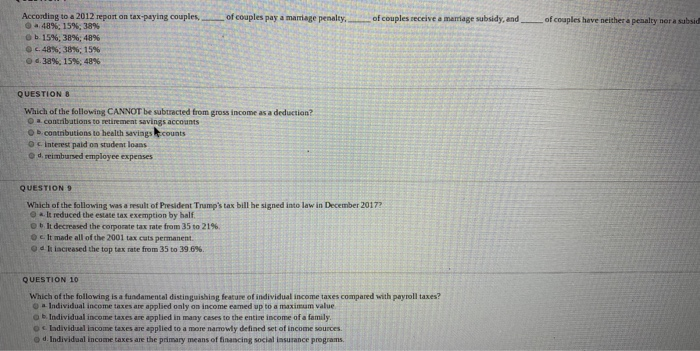

QUESTION 3 Derek sells a Rembrandt painting from his private collection to Phillip for $10 million. Which tax does Derek have to pay? O a individual income tax ob sales tax consumption tax d. capital gains tax of couples pay a marriage penalty... of couples receive a marriage subsidy, and __of couples have neither a penalty nera subsid According to a 2012 report on tax-paying couples a 48%, 15%, 38% Ob 15%, 38%; 48% c.48%; 38%, 15% d.3ak, 156, 48% 25 QUESTION 8 Which of the following CANNOT be subtracted from gross income as a a contributions to retirement savings accounts ob.contributions to health savingscounts Interest paid on student loans d. reimbursed employee expenses QUESTION 9 Which of the following was a result of President Trump's tax bill he signed into law in December 2017? It reduced the estate tax exemption by half b. It decreased the corporate tax rate from 35 to 21% It made all of the 2001 tax cuts permanent od increased the top tax rate from 35 to 39.6%. QUESTION 10 Which of the following is a fundamental distinguishing frature of individual income taxes compared with payroll taxes? Individual income taxes are applied only on income eamed up to a maximum value b. Individual income taxes are applied in many cases to the entire income of a family o Individual income taxes are applied to a more narrowly defined set of income sources Individual income taxes are the primary means of financing social insurance programs

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts