Question: QUESTION 3 Ella Traders is registered for VAT, afthough the annual turnover is less than R 1 0 0 0 0 0 0 . The

QUESTION

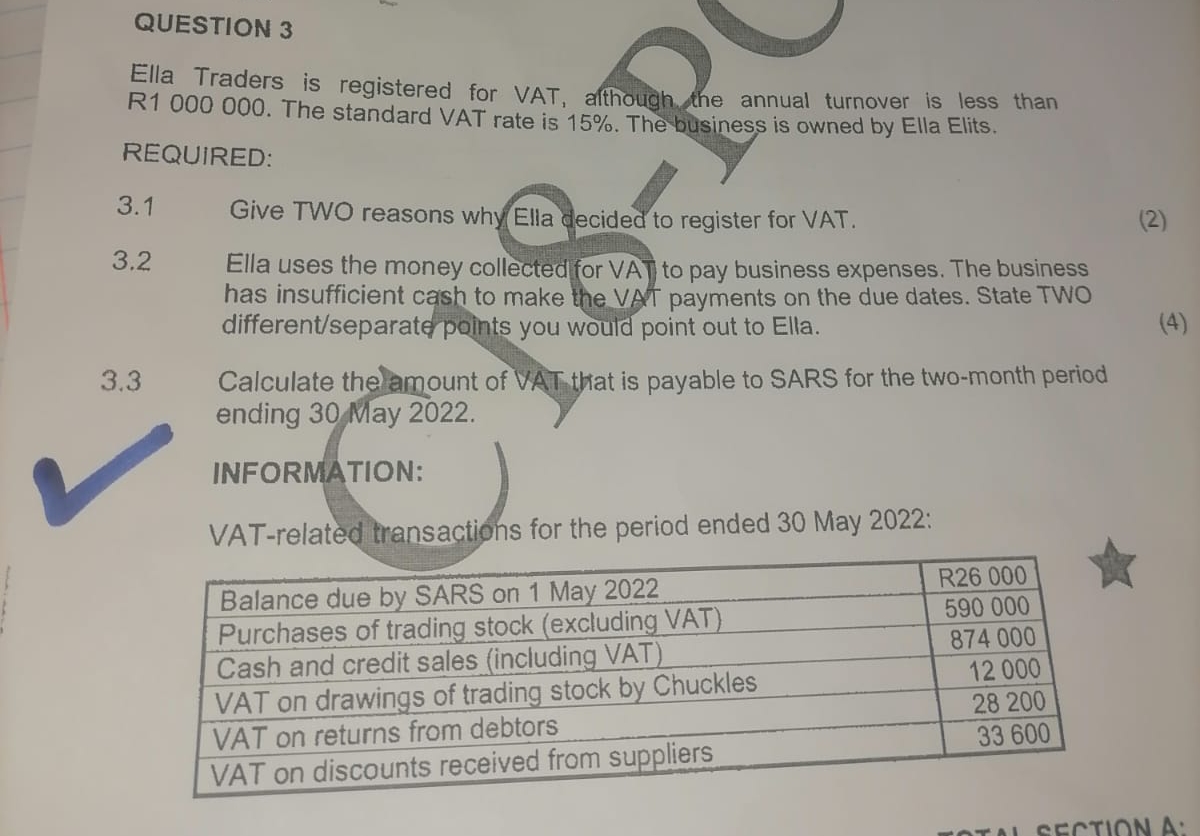

Ella Traders is registered for VAT, afthough the annual turnover is less than R The standard VAT rate is The business is owned by Ella Elits.

REQUIRED:

Give TWO reasons why Ella decided to register for VAT.

Ella uses the money collected for VA to pay business expenses. The business has insufficient cash to make the VAT payments on the due dates. State TWO differentseparaterpoints you would point out to Ella.

Calculate the amount of VAT that is payable to SARS for the twomonth period ending May

INFORMATION:

VATrelated transactions for the period ended May :

tableBalance due by SARS on May RPurchases of trading stock excluding VATCash and credit sales including VATVAT on drawings of trading stock by Chuckles,VAT on returns from debtors,VAT on discounts received from suppliers,

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock