Question: Question 3: Executives Randolph and Mortimer are choosing between two candidates to manage their investment firm, Duke & Duke. They want to make sure that

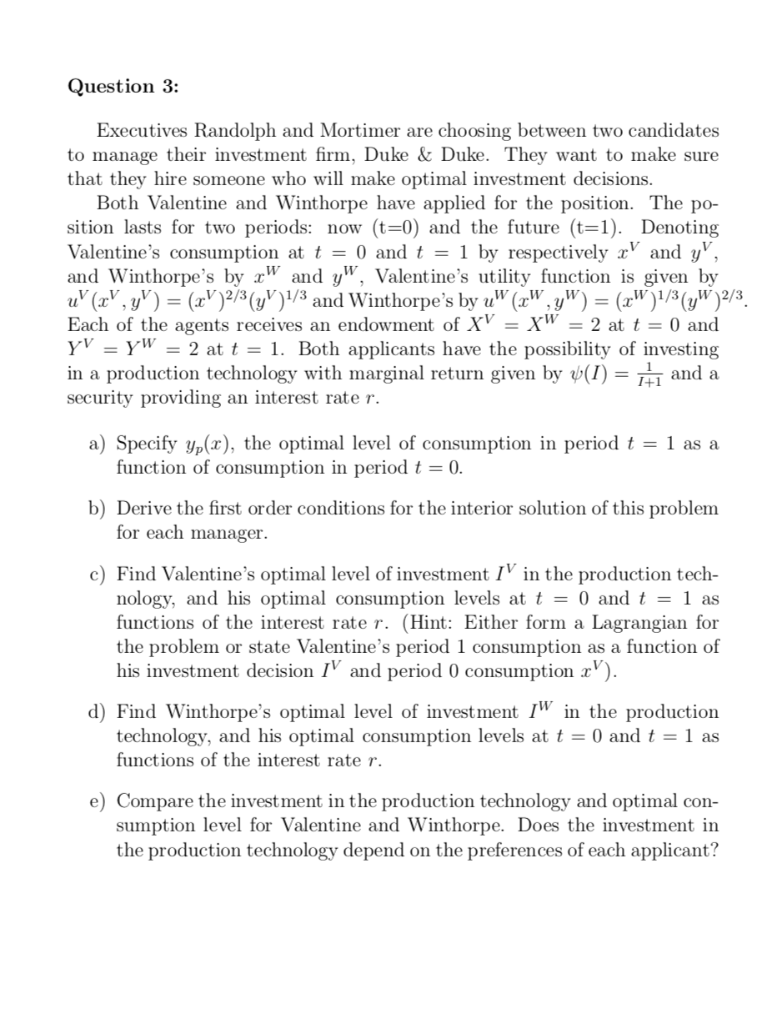

Question 3: Executives Randolph and Mortimer are choosing between two candidates to manage their investment firm, Duke & Duke. They want to make sure that they hire someone who will make optimal investment decisions Both Valentine and Winthorpe have applied for the position. The po- sition lasts for two periods: now (t-0) and the future (t-1). Denoting Valentine's consumption a0 and 1 by respectively z and yV, and Winthorpe's by r" and yW, Valentine's utility function is given by u(xyV))1/3 and Winthorpe's by u(WyW) -()*(y")2/3. Each of the agents receives an endowment of XV-XW-2 at t = 0 and YrV-YW-2 at t = 1. Both applicants have the possibility of investing in a production technology with marginal return given by and a security providing an interest rate r. a) Specify yp(x), the optimal level of consumption in period t1 as a function of consumption in period t -0 b) Derive the first order conditions for the interior solution of this problem for each manager. c) Find Valentine's optimal level of investment IV in the production tech- nology, and his optimal consumption levels at t 0 and t-1 as functions of the interest rate r. (Hint: Either form a Lagrangian for the problem or state Valentine's period 1 consumption as a function of his investment decision V and period 0 consumption . d) Find Winthorpe's optimal level of investment I in the production technology, and his optimal consumption levels at t = 0 and t = 1 as functions of the interest rate r. e) Compare the investment in the production technology and optimal con- sumption level for Valentine and Winthorpe. Does the investment in the production technology depend on the preferences of each applicant? Question 3: Executives Randolph and Mortimer are choosing between two candidates to manage their investment firm, Duke & Duke. They want to make sure that they hire someone who will make optimal investment decisions Both Valentine and Winthorpe have applied for the position. The po- sition lasts for two periods: now (t-0) and the future (t-1). Denoting Valentine's consumption a0 and 1 by respectively z and yV, and Winthorpe's by r" and yW, Valentine's utility function is given by u(xyV))1/3 and Winthorpe's by u(WyW) -()*(y")2/3. Each of the agents receives an endowment of XV-XW-2 at t = 0 and YrV-YW-2 at t = 1. Both applicants have the possibility of investing in a production technology with marginal return given by and a security providing an interest rate r. a) Specify yp(x), the optimal level of consumption in period t1 as a function of consumption in period t -0 b) Derive the first order conditions for the interior solution of this problem for each manager. c) Find Valentine's optimal level of investment IV in the production tech- nology, and his optimal consumption levels at t 0 and t-1 as functions of the interest rate r. (Hint: Either form a Lagrangian for the problem or state Valentine's period 1 consumption as a function of his investment decision V and period 0 consumption . d) Find Winthorpe's optimal level of investment I in the production technology, and his optimal consumption levels at t = 0 and t = 1 as functions of the interest rate r. e) Compare the investment in the production technology and optimal con- sumption level for Valentine and Winthorpe. Does the investment in the production technology depend on the preferences of each applicant

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts