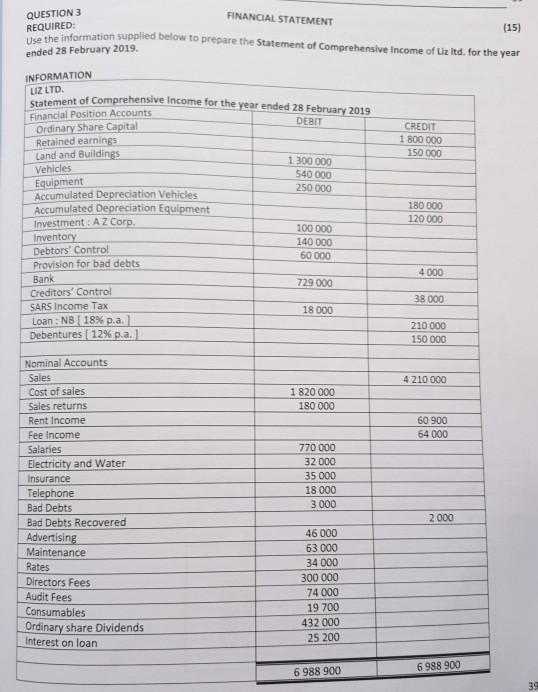

Question: QUESTION 3 FINANCIAL STATEMENT REQUIRED (15) Use the information supplied below to prepare the Statement of Comprehensive Income of Liz Itd. for the year ended

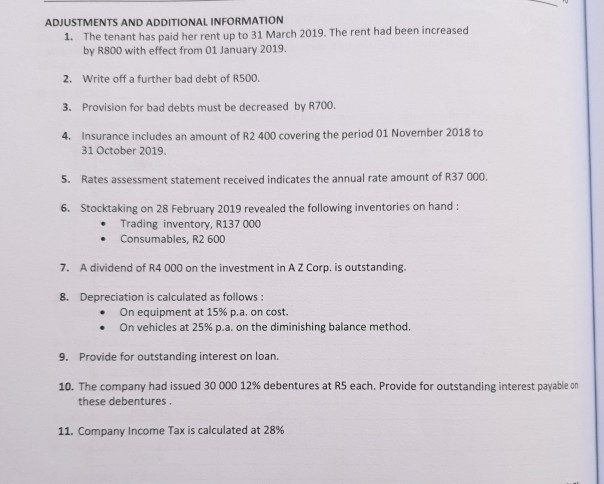

QUESTION 3 FINANCIAL STATEMENT REQUIRED (15) Use the information supplied below to prepare the Statement of Comprehensive Income of Liz Itd. for the year ended 28 February 2019. INFORMATION LIZ LTD Statement of Comprehensive Income for the year ended 28 February 2019 Financial Position Accounts Ordinary Share Capital Retained earnings Land and Buildings Vehicles DEBIT CREDIT 1 800 000 150 000 1 300 000 540 000 250 000 Equipment Accumulated Depreciation Vehicles Accumulated Depreciation Equipment Investment: AZ Corp. 180 000 120 000 100000 Inventory 140 000 Debtors' Control Provision for bad debts Bank 60 000 4 000 729 000 Creditors' Control 38 000 SARS Income Tax 18 000 Loan: NB 18 % p.a. Debentures [ 12 % p.a. 210 000 150 000 Nominal Accounts Sales 4 210 000 Cost of sales 1 820 000 Sales returns 180 000 60 900 Rent Income 64 000 Fee Income Salaries Electricity and Water 770 000 32 000 35 000 Insurance 18 000 Telephone Bad Debts 3 000 2 000 Bad Debts Recovered 46 000 Advertising 63 000 Maintenance 34 000 Rates 300 000 74 000 Directors Fees Audit Fees 19 700 Consumables 432 000 Ordinary share Dividends 25 200 Interest on loan 6988 900 6988 900 39 ADJUSTMENTS AND ADDITIONAL INFORMATION 1. The tenant has paid her rent up to 31 March 2019. The rent had been increased by R800 with effect from 01 January 2019. Write off a further bad debt of R500. 2. Provision for bad debts must be decreased by R700. 3. Insurance includes an amount of R2 400 covering the period 01 November 2018 to 31 October 2019. 4. S. Rates assessment statement received indicates the annual rate amount of R37 000. 6. Stocktaking on 28 February 2019 revealed the following inventories on hand: Trading inventory, R137 000 Consumables, R2 600 7. A dividend of R4 000 on the investment in A Z Corp. is outstanding. 8. Depreciation is calculated as follows: On equipment at 15 % p.a. on cost. On vehicles at 25% p.a. on the diminishing balance method. 9. Provide for outstanding interest on loan. 10. The company had issued 30 000 12 % debentures at R5 each. Provide for outstanding interest payable on these debentures 11. Company Income Tax is calculated at 28 %

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts