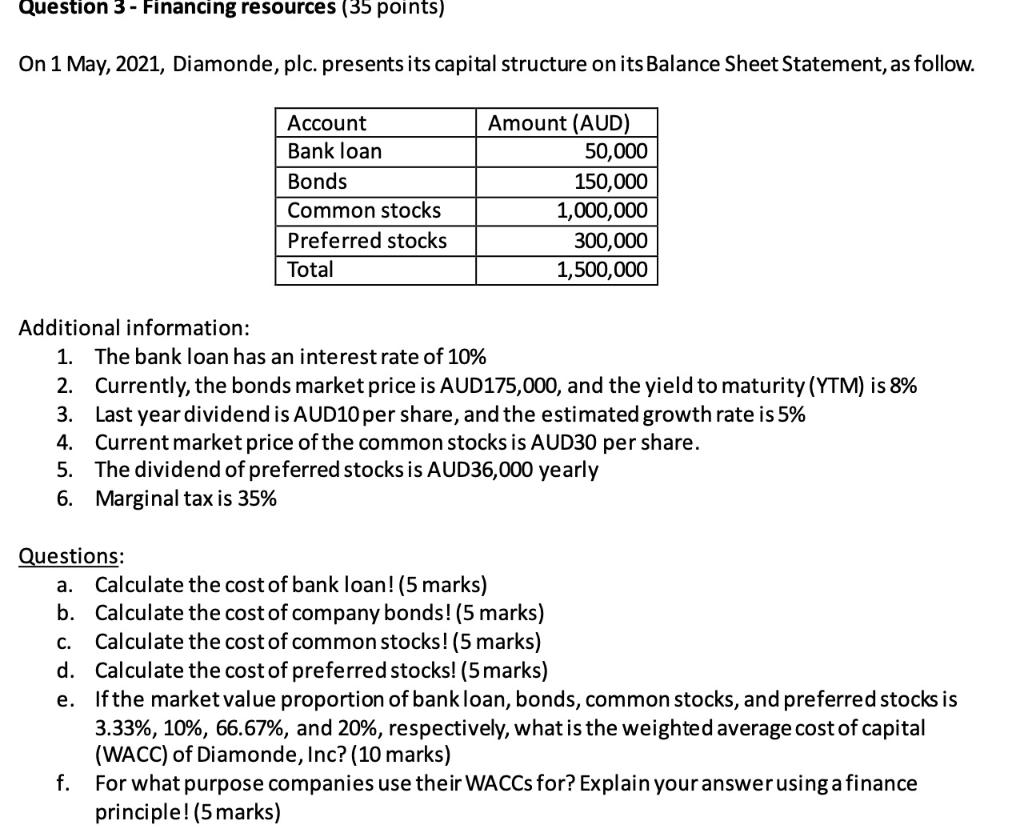

Question: Question 3 - Financing resources (35 points) On 1 May, 2021, Diamonde, plc. presents its capital structure on its Balance Sheet Statement, as follow. Account

Question 3 - Financing resources (35 points) On 1 May, 2021, Diamonde, plc. presents its capital structure on its Balance Sheet Statement, as follow. Account Bank loan Bonds Common stocks Preferred stocks Total Amount (AUD) 50,000 150,000 1,000,000 300,000 1,500,000 Additional information: 1. The bank loan has an interest rate of 10% 2. Currently, the bonds market price is AUD175,000, and the yield to maturity (YTM) is 8% 3. Last year dividend is AUD10 per share, and the estimated growth rate is 5% 4. Current market price of the common stocks is AUD30 per share. 5. The dividend of preferred stocks is AUD36,000 yearly 6. Marginal tax is 35% Questions: a. Calculate the cost of bank loan!(5 marks) b. Calculate the cost of company bonds! (5 marks) C. Calculate the cost of common stocks!(5 marks) d. Calculate the cost of preferred stocks! (5 marks) e. If the market value proportion of bankloan, bonds, common stocks, and preferred stocks is 3.33%, 10%, 66.67%, and 20%, respectively, what is the weighted average cost of capital (WACC) of Diamonde, Inc? (10 marks) f. For what purpose companies use their WACCs for? Explain your answer using a finance principle

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts