Question: Question 3: (from chapter 27) On 1 st January 2017 a business purchased a laser printer costing 1,800. The printer has an estimated life of

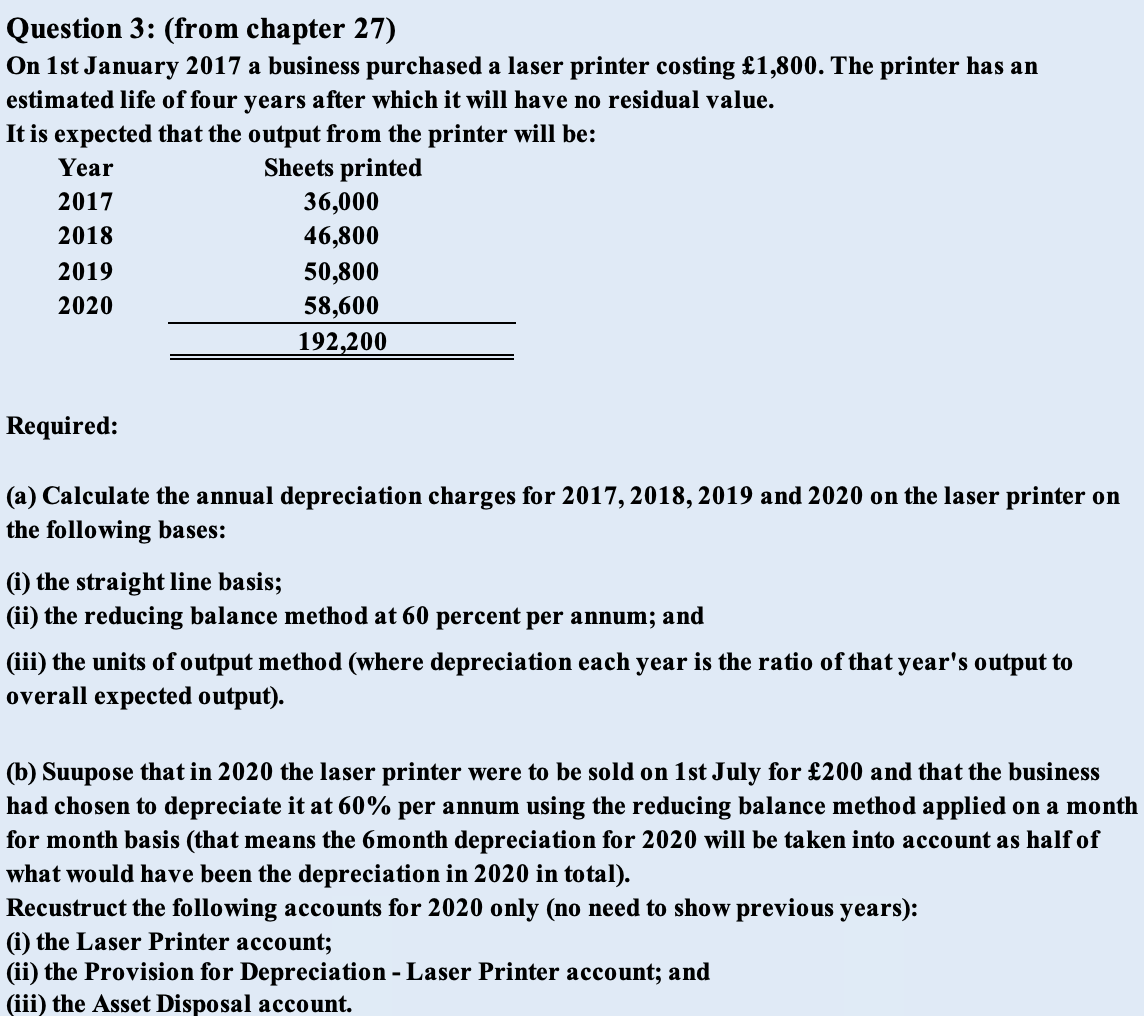

Question 3: (from chapter 27) On 1 st January 2017 a business purchased a laser printer costing 1,800. The printer has an estimated life of four years after which it will have no residual value. It is expected that the output from the printer will be: Required: (a) Calculate the annual depreciation charges for 2017, 2018,2019 and 2020 on the laser printer on the following bases: (i) the straight line basis; (ii) the reducing balance method at 60 percent per annum; and (iii) the units of output method (where depreciation each year is the ratio of that year's output to overall expected output). (b) Suupose that in 2020 the laser printer were to be sold on 1 st July for 200 and that the business had chosen to depreciate it at 60% per annum using the reducing balance method applied on a month for month basis (that means the 6 month depreciation for 2020 will be taken into account as half of what would have been the depreciation in 2020 in total). Recustruct the following accounts for 2020 only (no need to show previous years): (i) the Laser Printer account; (ii) the Provision for Depreciation - Laser Printer account; and (iii) the Asset Disposal account

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts