Question: QUESTION 3 Henry Wong, a trader, whose financial year ends on 31 December, purchased the following property, plant and equipment and paid by cheque: 1

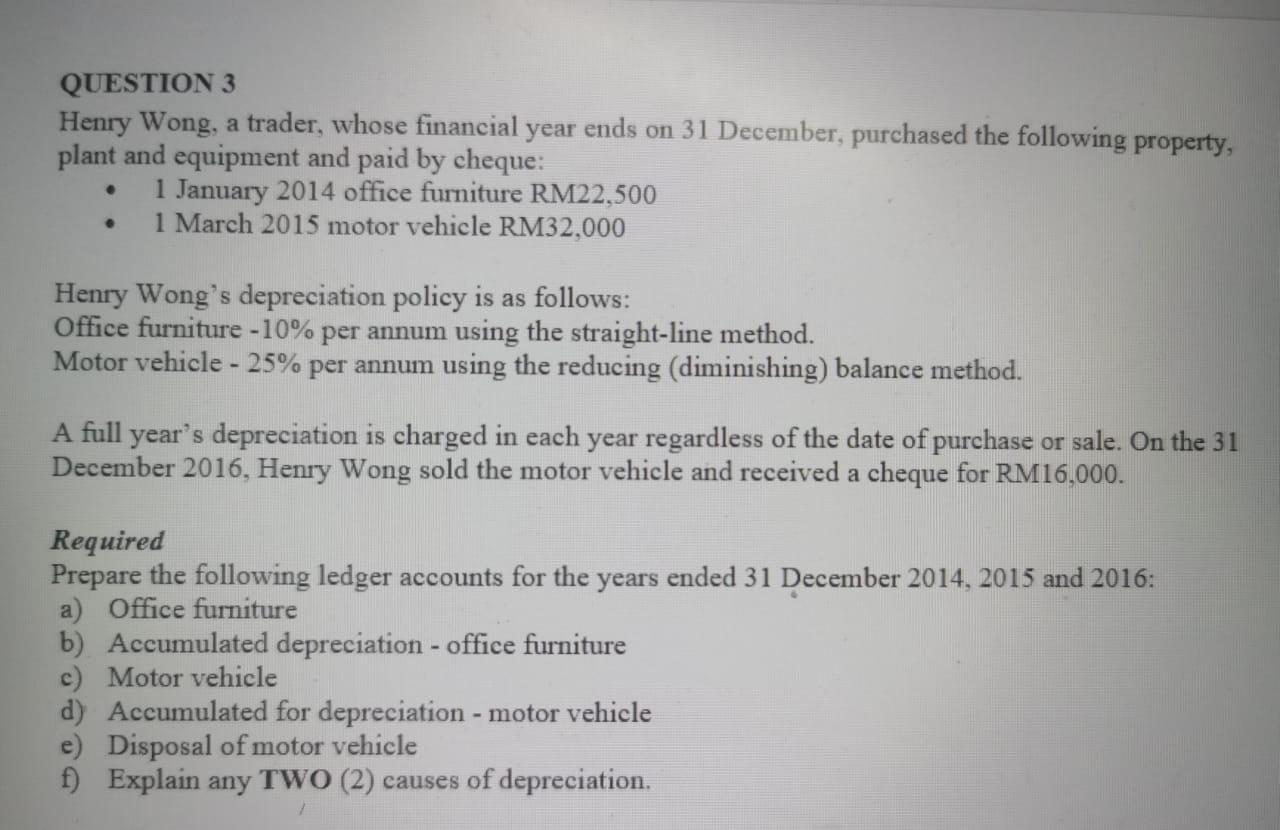

QUESTION 3 Henry Wong, a trader, whose financial year ends on 31 December, purchased the following property, plant and equipment and paid by cheque: 1 January 2014 office furniture RM22,500 1 March 2015 motor vehicle RM32,000 Henry Wong's depreciation policy is as follows: Office furniture -10% per annum using the straight-line method. Motor vehicle - 25% per annum using the reducing (diminishing) balance method. A full year's depreciation is charged in each year regardless of the date of purchase or sale. On the 31 December 2016, Henry Wong sold the motor vehicle and received a cheque for RM16,000. Required Prepare the following ledger accounts for the years ended 31 December 2014, 2015 and 2016: a) Office furniture b) Accumulated depreciation - office furniture c) Motor vehicle d) Accumulated for depreciation - motor vehicle e) Disposal of motor vehicle f) Explain any TWO (2) causes of depreciation

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts