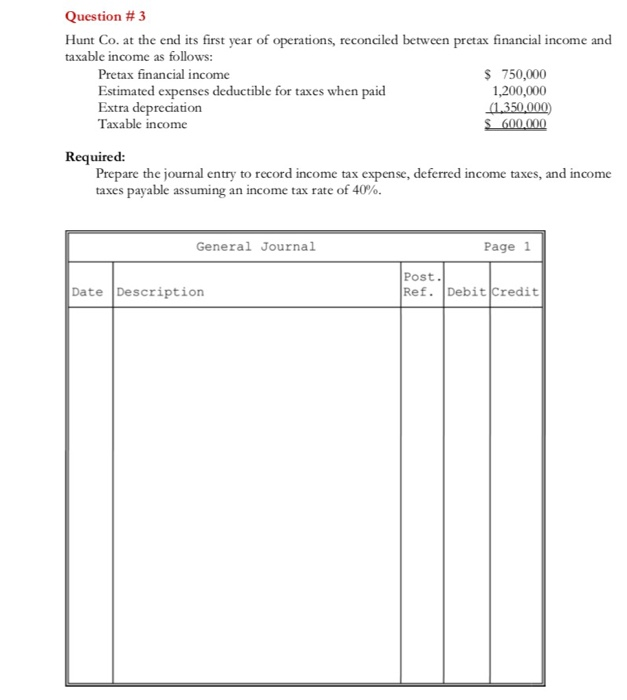

Question: Question # 3 Hunt Co. at the end its first year of operations, reconciled between pretax financial income and taxable income as follows Pretax financial

Question # 3 Hunt Co. at the end its first year of operations, reconciled between pretax financial income and taxable income as follows Pretax financial income Estimated expenses deductible for taxes when paid Extra depreciation Taxable income s 750,000 1,200,000 1350,000) Required: Prepare the journal entry to record income tax expense, deferred income taxes, and income taxes payable assuming an income tax rate of 40% General Journal Page 1 Post. Ref. Debit Credit Date Description

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts