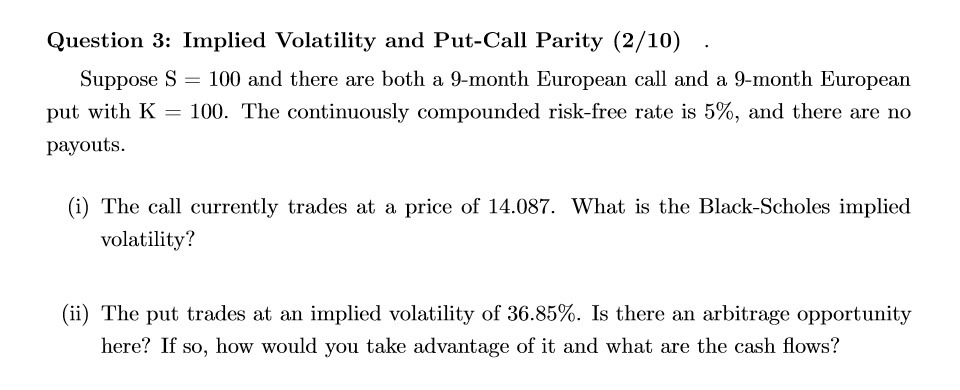

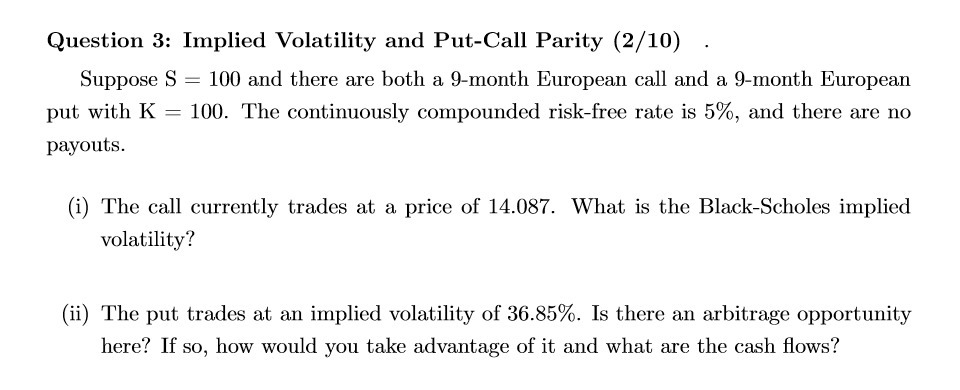

Question: Question 3 : Implied Volatility and Put - Call Parity ( 2 / 10 ) Suppose S = 100 and there are both a 9

Question 3 : Implied Volatility and Put - Call Parity ( 2 / 10 ) Suppose S = 100 and there are both a 9 - month European call and a 9 -month European put with K - 100 . The continuously compounded risk - free rate is 5% , and there are no payouts ( 1 ) The call currently trades at a price of 14087 . What is the Black - Scholes implied volatility ? ( 11 ) The put trades at an implied volatility of 3685% Is there an arbitrage opportunity here ? If so , how would you take advantage of it and what are the cash flows

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts