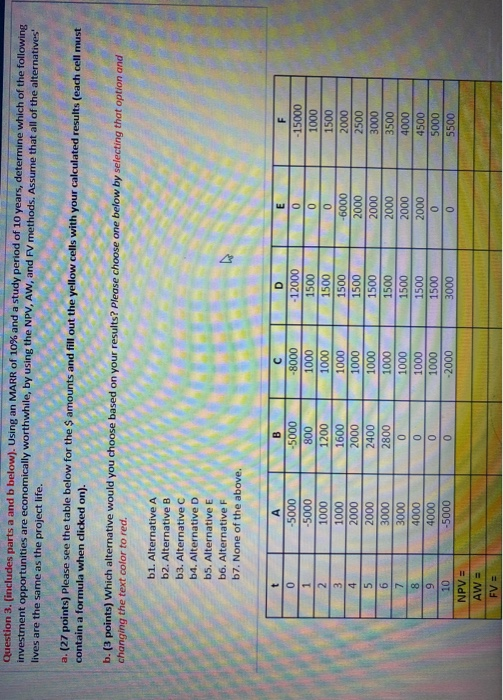

Question: Question 3. [includes parts a and b below). Using an MARR of 10% and a study period of 10 years, determine which of the following

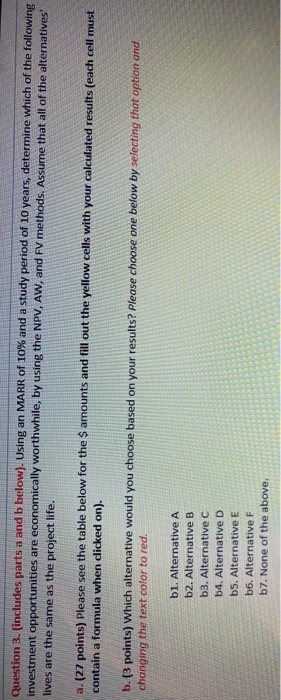

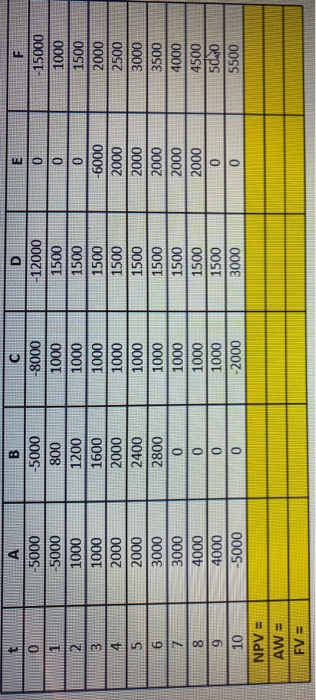

Question 3. [includes parts a and b below). Using an MARR of 10% and a study period of 10 years, determine which of the following investment opportunities are economically worthwhile, by using the NPV, AW, and FV methods. Assume that all of the alternatives lives are the same as the project life. a. (27 points) Please see the table below for the $ amounts and fill out the yellow cells with your calculated results (each cell must contain a formula when dicked on). b. (3 points) Which alternative would you choose based on your results? Please choose one below by selecting that option and changing the text color to red. b1. Alternative A b2. Alternative B b3. Alternative C 54. Alternative D b5. Alternative E b6. Alternative F b7. None of the above. D t E 0 0 1 2 3 4 -5000 -5000 1000 1000 2000 2000 3000 3000 4000 4000 -5000 B -5000 800 1200 1600 2000 2400 2800 0 0 0 0 -8000 1000 1000 1000 1000 1000 1000 1000 1000 1000 -2000 5 - 12000 1500 1500 1500 1500 1500 1500 1500 1500 1500 3000 -15000 1000 1500 2000 2500 3000 3500 4000 4500 5000 5500 0 0 -6000 2000 2000 2000 2000 2000 0 0 6 7 8 9 10 NPV = AW= FV = Question 3. (includes parts a and b below). Using an MARR of 10% and a study period of 10 years, determine which of the following investment opportunities are economically worthwhile, by using the NPV, AW, and FV methods. Assume that all of the alternatives' lives are the same as the project life. a. (27 points) Please see the table below for the $ amounts and fill out the yellow cells with your calculated results (each cell must contain a formula when clicked on). b. (3 points) Which alternative would you choose based on your results? Please choose one below by selecting that option and changing the text color to red. b1. Alternative A b2. Alternative B b3. Alternative C b4. Alternative D 65. Alternative E b6. Alternative F b7. None of the above. A B D E 0 0 5000 5000 1000 1000 2000 2000 3000 3000 4000 4000 -5000 -5000 800 1200 1600 2000 2400 2800 0 -8000 1000 1000 1000 1000 1000 1000 1000 1000 1000 -2000 -12000 1500 1500 1500 1500 1500 1500 1500 1500 1500 3000 0 0 -6000 2000 2000 2000 2000 2000 0 F 15000 1000 1500 2000 2500 3000 3500 4000 4500 500 5500 6 0 0 7 8 9 10 NPV = AW= FV = 0 0

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts