Question: Question 3 (includes portions a, b, and c). Consider the project below and answer the following questions based on this data set. Investment: $40,000 Annual

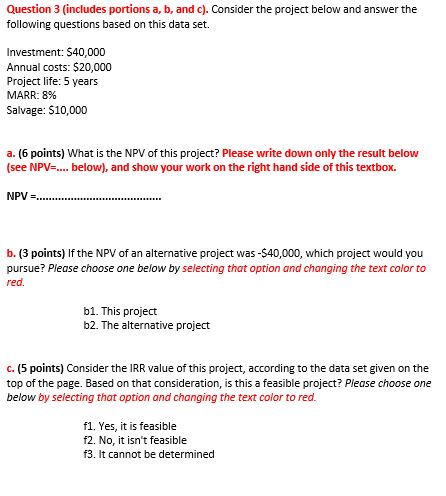

Question 3 (includes portions a, b, and c). Consider the project below and answer the following questions based on this data set. Investment: $40,000 Annual costs: $20,000 Project life: 5 years MARR: 8% Salvage: $10,000 a. (6 points) What is the NPV of this project? Please write down only the result below (see NPV-... below), and show your work on the right hand side of this textbox. NPV =.. ........... b. (3 points) If the NPV of an alternative project was -$40,000, which project would you pursue? Please choose one below by selecting that option and changing the text color to red. b1. This project b2. The alternative project c. (5 points) Consider the IRR value of this project, according to the data set given on the top of the page. Based on that consideration, is this a feasible project? Please choose one below by selecting that option and changing the text color to red. f1. Yes, it is feasible f2. No, it isn't feasible f3. It cannot be determined

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts