Question: Question 3 : Inflation Credibility and Supply Shocks A small open economy is experiencing a negative supply shock due to rising global oil prices. The

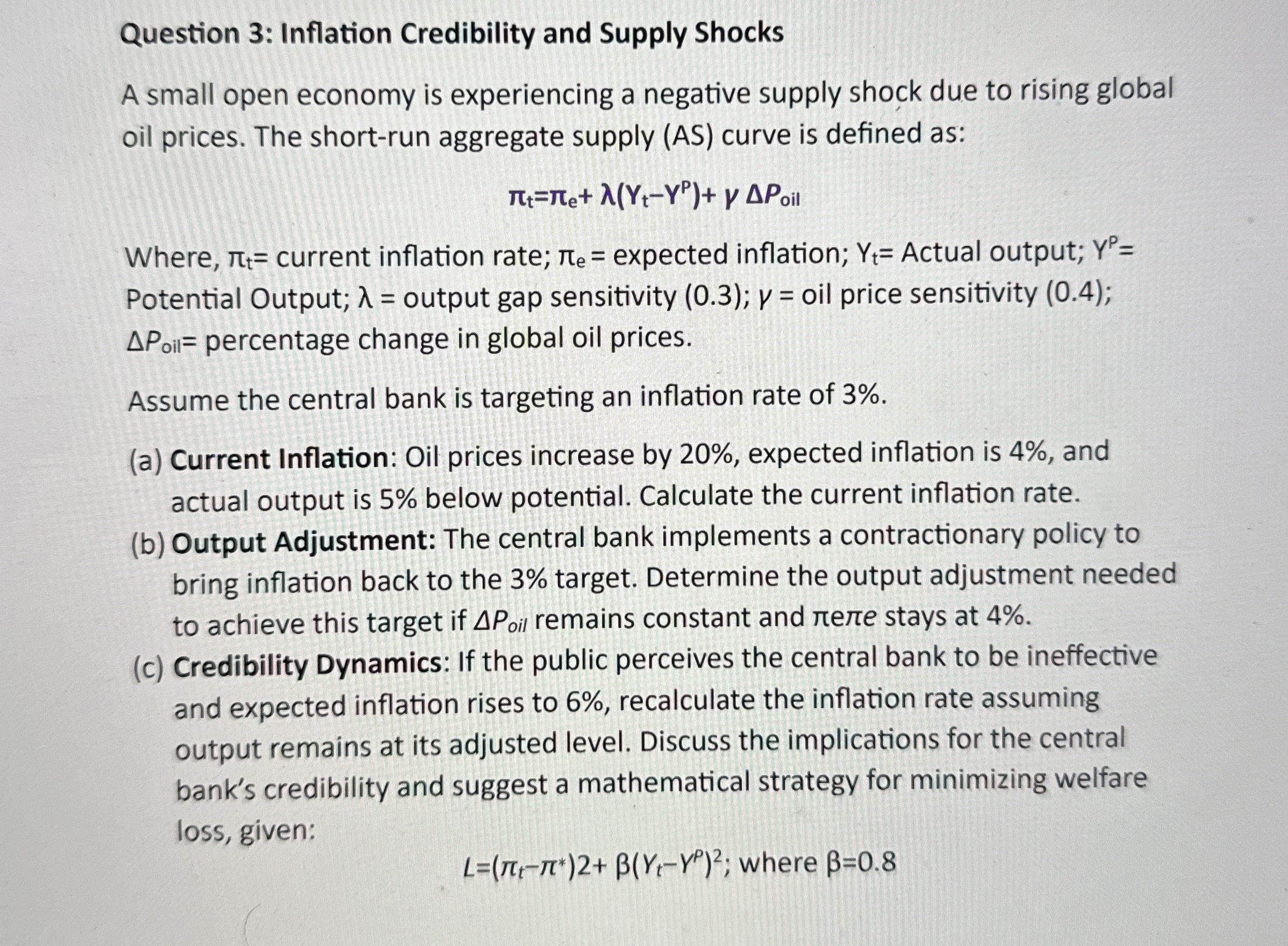

Question : Inflation Credibility and Supply Shocks

A small open economy is experiencing a negative supply shock due to rising global oil prices. The shortrun aggregate supply AS curve is defined as:

Where, current inflation rate; expected inflation; Actual output; Potential Output; output gap sensitivity ;

oil price sensitivity ; percentage change in global oil prices.

Assume the central bank is targeting an inflation rate of

a Current Inflation: Oil prices increase by expected inflation is and actual output is below potential. Calculate the current inflation rate.

b Output Adjustment: The central bank implements a contractionary policy to bring inflation back to the target. Determine the output adjustment needed to achieve this target if remains constant and re re stays at

c Credibility Dynamics: If the public perceives the central bank to be ineffective and expected inflation rises to recalculate the inflation rate assuming output remains at its adjusted level. Discuss the implications for the central bank's credibility and suggest a mathematical strategy for minimizing welfare loss, given:

; where

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock