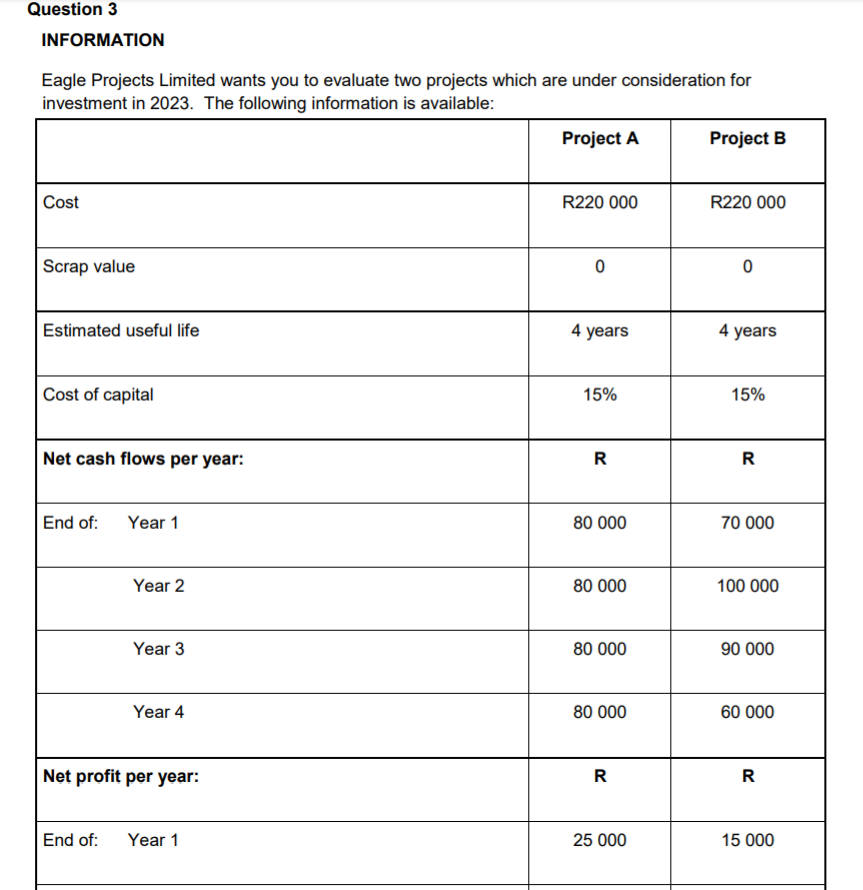

Question: Question 3 INFORMATION Eagle Projects Limited wants you to evaluate two projects which are under consideration for investment in 2023. The following information is available:

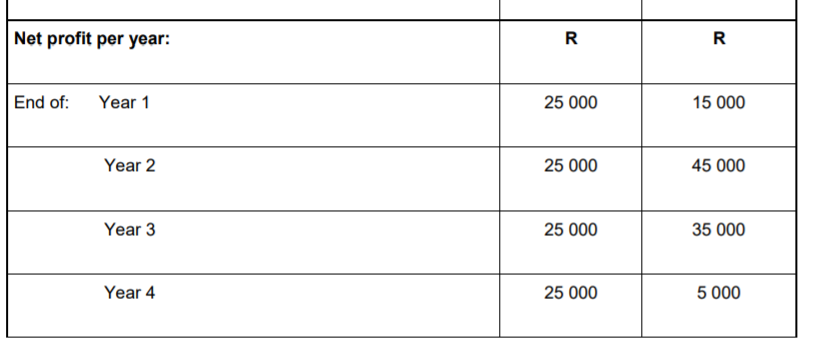

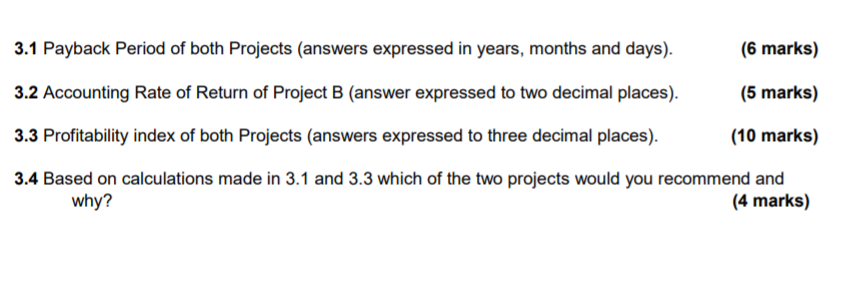

Question 3 INFORMATION Eagle Projects Limited wants you to evaluate two projects which are under consideration for investment in 2023. The following information is available: Project A Project B Cost R220 000 R220 000 Scrap value 0 0 Estimated useful life 4 years 4 years Cost of capital 15% 15% Net cash flows per year: R R End of: Year 1 80 000 70 000 Year 2 80 000 100 000 Year 3 80 000 90 000 Year 4 80 000 60 000 Net profit per year: R R End of: Year 1 25 000 15 000 Net profit per year: R R End of: Year 1 25 000 15 000 Year 2 25 000 45 000 Year 3 25 000 35 000 Year 4 25 000 5 000 3.1 Payback Period of both Projects (answers expressed in years, months and days). (6 marks) 3.2 Accounting Rate of Return of Project B (answer expressed to two decimal places). (5 marks) 3.3 Profitability index of both Projects (answers expressed to three decimal places). (10 marks) 3.4 Based on calculations made in 3.1 and 3.3 which of the two projects would you recommend and why? (4 marks)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts