Question: Question 3 Inkpad Ltd is a printery and has been an audit client of Lewis & Associates for several years. Dennis Reid has been the

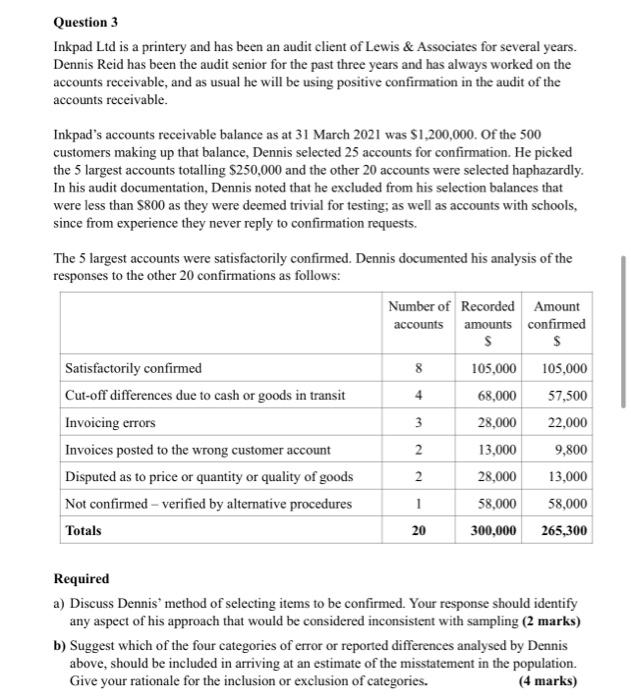

Question 3 Inkpad Ltd is a printery and has been an audit client of Lewis & Associates for several years. Dennis Reid has been the audit senior for the past three years and has always worked on the accounts receivable, and as usual he will be using positive confirmation in the audit of the accounts receivable. Inkpad's accounts receivable balance as at 31 March 2021 was $1,200,000. Of the 500 customers making up that balance, Dennis selected 25 accounts for confirmation. He picked the 5 largest accounts totalling $250,000 and the other 20 accounts were selected haphazardly. In his audit documentation, Dennis noted that he excluded from his selection balances that were less than $800 as they were deemed trivial for testing, as well as accounts with schools, since from experience they never reply to confirmation requests. The 5 largest accounts were satisfactorily confirmed. Dennis documented his analysis of the responses to the other 20 confirmations as follows: Number of Recorded Amount accounts amounts confirmed $ $ Satisfactorily confirmed 8 105,000 105,000 Cut-off differences due to cash or goods in transit 4 68,000 57,500 Invoicing errors 3 28,000 22,000 Invoices posted to the wrong customer account 2 13,000 9,800 Disputed as to price or quantity or quality of goods 2 28,000 13,000 Not confirmed - verified by alternative procedures 1 58,000 58,000 Totals 20 300,000 265,300 Required a) Discuss Dennis method of selecting items to be confirmed. Your response should identify any aspect of his approach that would be considered inconsistent with sampling (2 marks) b) Suggest which of the four categories of error or reported differences analysed by Dennis above, should be included in arriving at an estimate of the misstatement in the population. Give your rationale for the inclusion or exclusion of categories. (4 marks) Question 3 Inkpad Ltd is a printery and has been an audit client of Lewis & Associates for several years. Dennis Reid has been the audit senior for the past three years and has always worked on the accounts receivable, and as usual he will be using positive confirmation in the audit of the accounts receivable. Inkpad's accounts receivable balance as at 31 March 2021 was $1,200,000. Of the 500 customers making up that balance, Dennis selected 25 accounts for confirmation. He picked the 5 largest accounts totalling $250,000 and the other 20 accounts were selected haphazardly. In his audit documentation, Dennis noted that he excluded from his selection balances that were less than $800 as they were deemed trivial for testing, as well as accounts with schools, since from experience they never reply to confirmation requests. The 5 largest accounts were satisfactorily confirmed. Dennis documented his analysis of the responses to the other 20 confirmations as follows: Number of Recorded Amount accounts amounts confirmed $ $ Satisfactorily confirmed 8 105,000 105,000 Cut-off differences due to cash or goods in transit 4 68,000 57,500 Invoicing errors 3 28,000 22,000 Invoices posted to the wrong customer account 2 13,000 9,800 Disputed as to price or quantity or quality of goods 2 28,000 13,000 Not confirmed - verified by alternative procedures 1 58,000 58,000 Totals 20 300,000 265,300 Required a) Discuss Dennis method of selecting items to be confirmed. Your response should identify any aspect of his approach that would be considered inconsistent with sampling (2 marks) b) Suggest which of the four categories of error or reported differences analysed by Dennis above, should be included in arriving at an estimate of the misstatement in the population. Give your rationale for the inclusion or exclusion of categories. (4 marks)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts