Question: QUESTION 3 (L03) 1) SunSuria Berhad is evaluating a project that has an initial after-tax cost of RM5,000,000 and is expected to provide after-tax operating

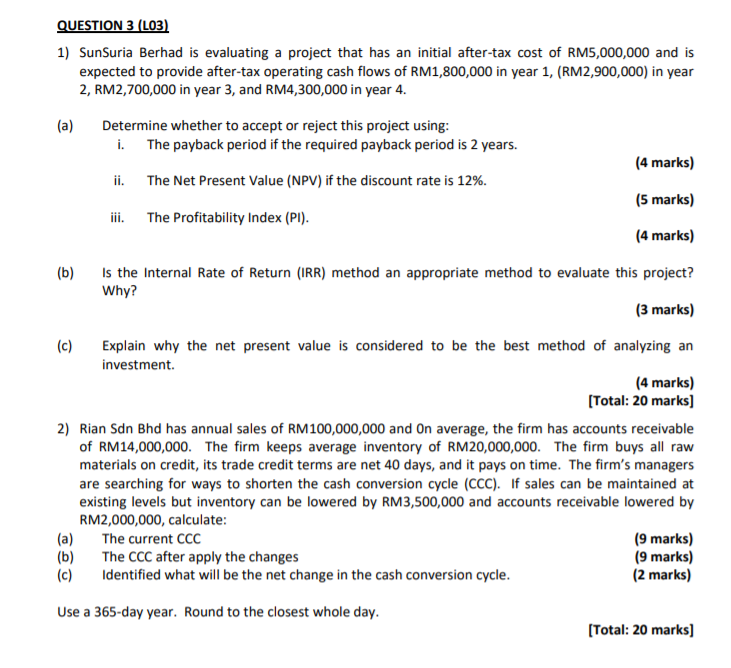

QUESTION 3 (L03) 1) SunSuria Berhad is evaluating a project that has an initial after-tax cost of RM5,000,000 and is expected to provide after-tax operating cash flows of RM1,800,000 in year 1, (RM2,900,000) in year 2, RM2,700,000 in year 3, and RM4,300,000 in year 4. (a) Determine whether to accept or reject this project using: i. The payback period if the required payback period is 2 years. (4 marks) ii. The Net Present Value (NPV) if the discount rate is 12%. (5 marks) iii. The Profitability Index (Pl). (4 marks) (b) Is the Internal Rate of Return (IRR) method an appropriate method to evaluate this project? Why? (3 marks) (c) Explain why the net present value is considered to be the best method of analyzing an investment (4 marks) [Total: 20 marks] 2) Rian Sdn Bhd has annual sales of RM100,000,000 and On average, the firm has accounts receivable of RM14,000,000. The firm keeps average inventory of RM20,000,000. The firm buys all raw materials on credit, its trade credit terms are net 40 days, and it pays on time. The firm's managers are searching for ways to shorten the cash conversion cycle (CCC). If sales can be maintained at existing levels but inventory can be lowered by RM3,500,000 and accounts receivable lowered by RM2,000,000, calculate: (a) The current CCC (9 marks) The CCC after apply the changes (9 marks) (c) Identified what will be the net change in the cash conversion cycle. (2 marks) (b) Use a 365-day year. Round to the closest whole day. [Total: 20 marks]

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts