Question: Question 3 Lundstrom Ltd. (LL) has a December 31 year end. The company purchased a piece of equipment on June 22, 2020, at a cost

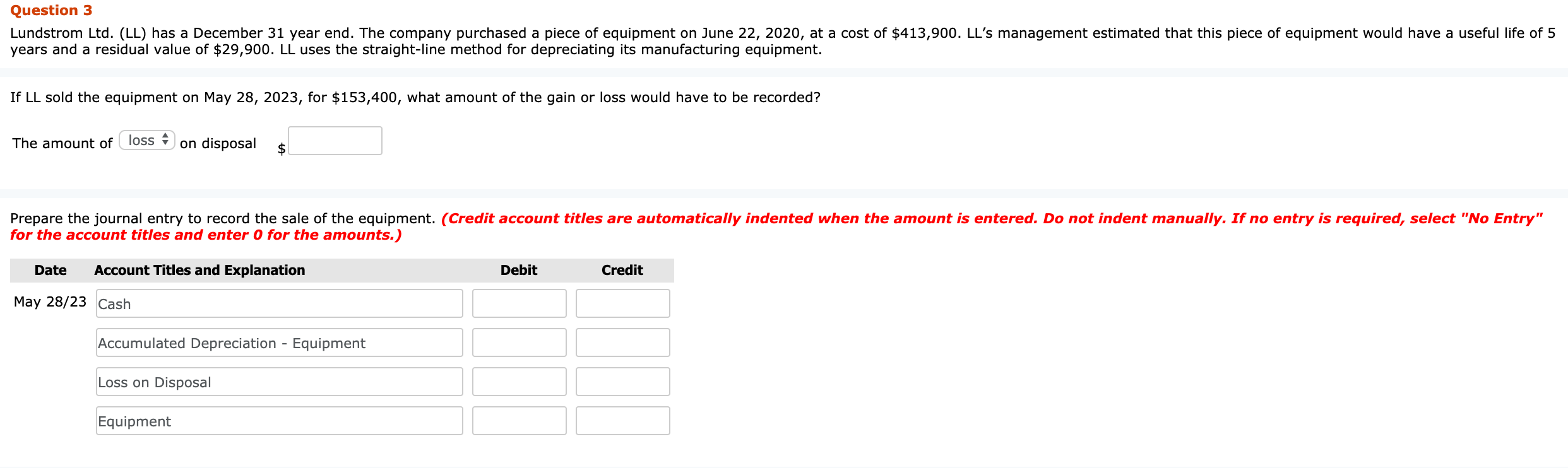

Question 3 Lundstrom Ltd. (LL) has a December 31 year end. The company purchased a piece of equipment on June 22, 2020, at a cost of $413,900. LL's management estimated that this piece of equipment would have a useful life of 5 years and a residual value of $29,900. LL uses the straight-line method for depreciating its manufacturing equipment. If LL sold the equipment on May 28, 2023, for $153,400, what amount of the gain or loss would have to be recorded? The amount of loss on disposal $ Prepare the journal entry to record the sale of the equipment. (Credit account titles are automatically indented when the amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter o for the amounts.) Date Account Titles and Explanation Debit Credit May 28/23 Cash Accumulated Depreciation - Equipment Loss on Disposal Equipment

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts