Question: Question 3 Make the necessary assumptions to solve this question. Be sure to answer all sub questions. Explain your calculations, support your answers and state

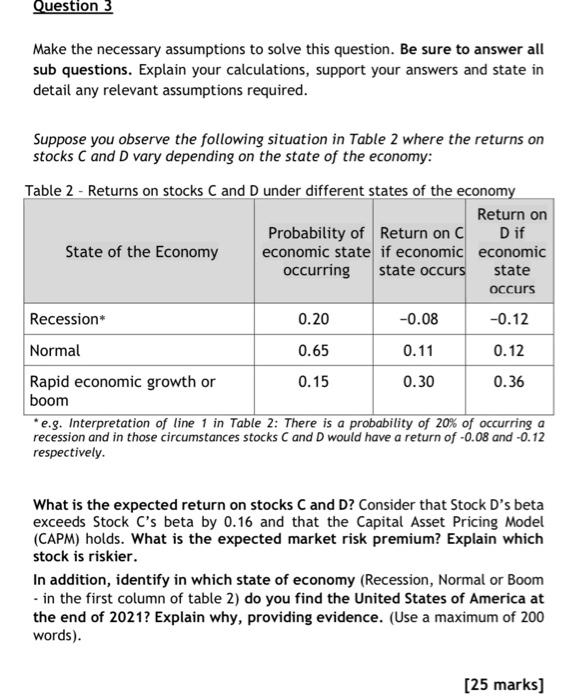

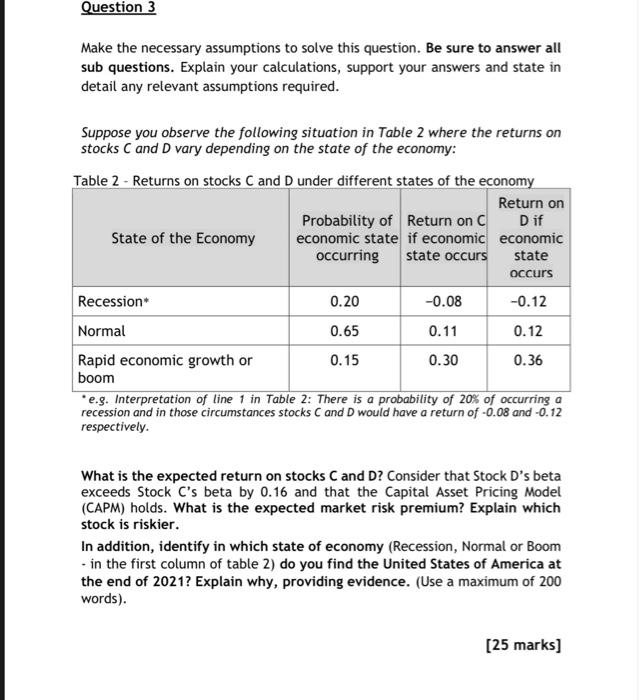

Question 3 Make the necessary assumptions to solve this question. Be sure to answer all sub questions. Explain your calculations, support your answers and state in detail any relevant assumptions required. Suppose you observe the following situation in Table 2 where the returns on stocks C and D vary depending on the state of the economy: Table 2 - Returns on stocks C and D under different states of the economy Return on Probability of Return on C Dif State of the Economy economic state if economic economic occurring state occurs state occurs Recession* 0.20 -0.08 -0.12 Normal 0.65 0.11 0.12 Rapid economic growth or 0.15 0.36 boom * e.3. Interpretation of line 1 in Table 2: There is a probability of 20% of occurring a recession and in those circumstances stocks C and D would have a return of -0.08 and -0.12 respectively. 0.30 What is the expected return on stocks C and D? Consider that Stock D's beta exceeds Stock C's beta by 0.16 and that the Capital Asset Pricing Model (CAPM) holds. What is the expected market risk premium? Explain which stock is riskier. In addition, identify in which state of economy (Recession, Normal or Boom - in the first column of table 2) do you find the United States of America at the end of 2021? Explain why, providing evidence. (Use a maximum of 200 words). [25 marks] Question 3 Make the necessary assumptions to solve this question. Be sure to answer all sub questions. Explain your calculations, support your answers and state in detail any relevant assumptions required. Suppose you observe the following situation in Table 2 where the returns on stocks C and D vary depending on the state of the economy: Table 2 - Returns on stocks C and D under different states of the economy Return on Probability of Return on Dif State of the Economy economic state if economic economic occurring state occurs state occurs Recession 0.20 -0.08 -0.12 Normal 0.65 0.11 0.12 Rapid economic growth or 0.15 0.30 0.36 boom *e.g. Interpretation of line 1 in Table 2: There is a probability of 20% of occurring a recession and in those circumstances stocks C and D would have a return of -0.08 and -0.12 respectively. What is the expected return on stocks C and D? Consider that Stock D's beta exceeds Stock C's beta by 0.16 and that the Capital Asset Pricing Model (CAPM) holds. What is the expected market risk premium? Explain which stock is riskier. In addition, identify in which state of economy (Recession, Normal or Boom in the first column of table 2) do you find the United States of America at the end of 2021? Explain why, providing evidence. (Use a maximum of 200 words). [25 marks]

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts