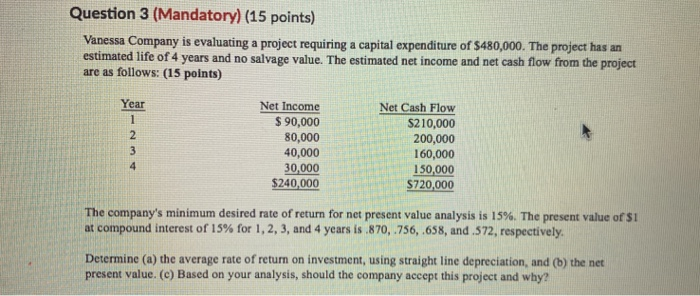

Question: Question 3 (Mandatory) (15 points) Vanessa Company is evaluating a project requiring a capital expenditure of $480,000. The project has an estimated life of 4

Question 3 (Mandatory) (15 points) Vanessa Company is evaluating a project requiring a capital expenditure of $480,000. The project has an estimated life of 4 years and no salvage value. The estimated net income and net cash flow from the project are as follows: (15 points) Year Net Income $ 90,000 80,000 40,000 30,000 $240,000 Net Cash Flow $210,000 200,000 160,000 150,000 $720,000 The company's minimum desired rate of return for net present value analysis is 15%. The present value of $1 at compound interest of 15% for 1, 2, 3, and 4 years is.870,.756,.658, and.572, respectively. Determine (a) the average rate of return on investment, using straight line depreciation, and (b) the net present value. (c) Based on your analysis, should the company accept this project and why

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts