Question: Question 3 : Marks ( 1 3 + 1 2 + 1 0 ) A US Biotech firm plans to expand its operation in Singapore

Question : Marks

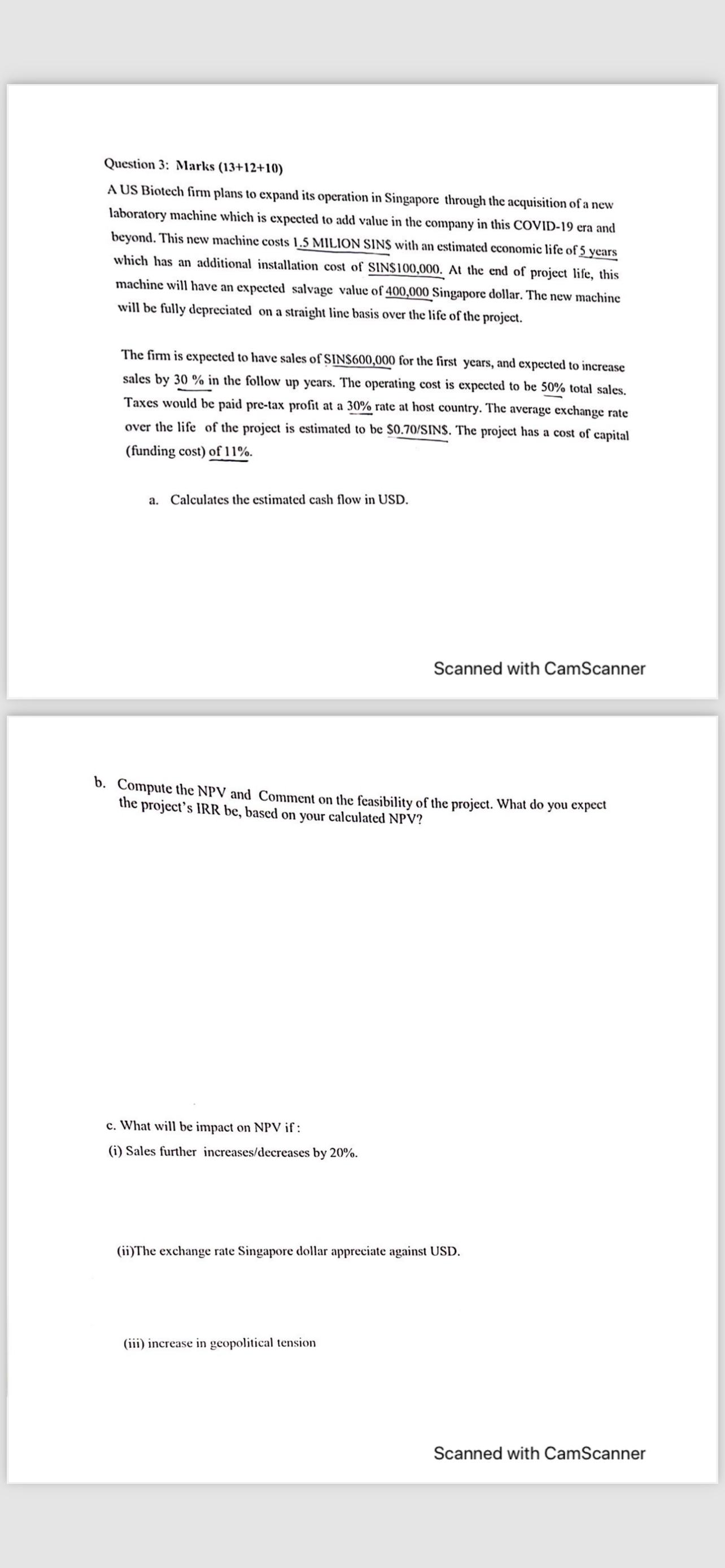

A US Biotech firm plans to expand its operation in Singapore through the acquisition of a new laboratory machine which is expected to add value in the company in this COVID era and beyond. This new machine costs MILION SINS with an estimated cconomic life of years which has an additional installation cost of SIN $ At the end of project life, this machine will have an expected salvage value of Singapore dollar. The new machine will be fully depreciated on a straight line basis over the life of the project.

The firm is expected to have sales of SINS for the first years, and expected to increase sales by in the follow up years. The operating cost is expected to be total sales. Taxes would be paid pretax profit at a rate at host country. The average exchange rate over the life of the project is estimated to be $ The project has a cost of capital funding cost of

a Calculates the estimated cash flow in USD.

Scanned with CamScanner

b Compute the NPV and Comment on the feasibility of the project. What do you expect the project's IRR be based on your calculated NPV

c What will be impact on NPV if :

i Sales further increasesdecreases by

iiThe exchange rate Singapore dollar appreciate against USD.

iii increase in geopolitical tension

Scanned with CamScanner

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock