Question: Question 3 (Marks: 15) You are an analyst on the investment team for Retire-Safe Ltd and have been requested by your team leader to analyse

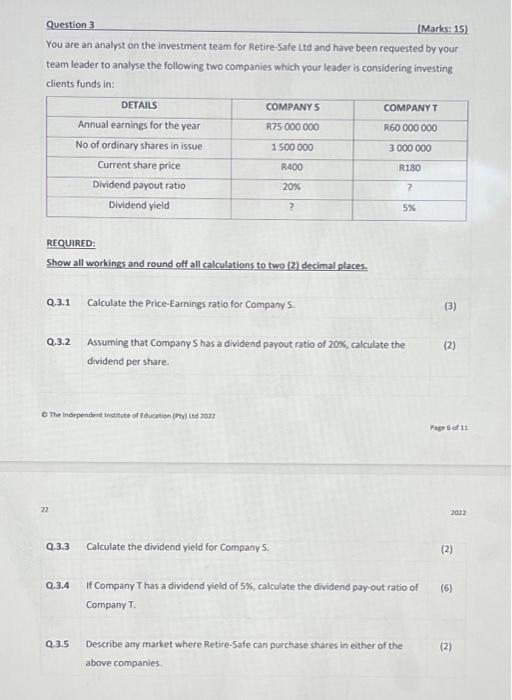

Question 3 (Marks: 15) You are an analyst on the investment team for Retire-Sufe Ltd and have been requested by your team leader to analyse the following two companies which vour leader is considering investing clients funds in: REQUIRED: Show all workings and round off all calculations to two (2) decimal places. Q.3.1 Calculate the Price-Earnings ratio for Company 5. (3) Q.3.2 Assuming that Company 5 has a dividend payout ratio of 20%, calculate the (2) dividend per share. O The independent inctitute of Fducrtion (p)y thd sozz Page 6 ar 11 n 2002 Q.3.3 Calculate the dividend yield for Company S. (2) Q.3.4 If Company Thas a dividend yield of 5%, calculate the dividend pay-out ratio of (6) Company T. Q.3.5 Describe any market where Retire-Safe can purchase shares in either of the (2) above companies

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts