Question: Question 3 (Marks: 301 Q.3.1 CVD Ltd needs to choose from three mutually exclusive projects. The net cash flows (13) from the projects will depend

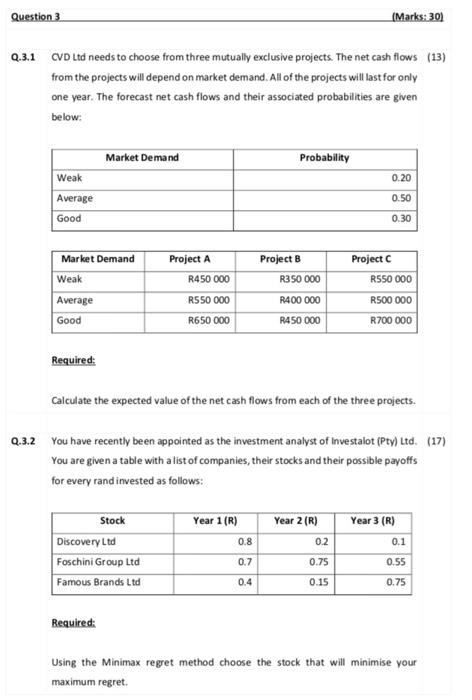

Question 3 (Marks: 301 Q.3.1 CVD Ltd needs to choose from three mutually exclusive projects. The net cash flows (13) from the projects will depend on market demand. All of the projects will last for only one year. The forecast net cash flows and their associated probabilities are given below: Market Demand Probability Weak 0.20 Average 0.50 Good 0.30 Project A Market Demand Weak Average Good R450 000 R550 000 R650 000 Project B R350 000 R400 000 R450 000 Project R550 000 R500 000 R700 000 Required: Calculate the expected value of the net cash flows from each of the three projects. Q.3.2 You have recently been appointed as the investment analyst of Investalot (Pty) Ltd. (17) You are given a table with a list of companies, their stocks and their possible payoffs for every rand invested as follows: Year 1 (R) 0.8 Year 3 (R) Stock Discovery Ltd Foschini Group Ltd Famous Brands Ltd Year 2 (R) 0.2 0.75 0.1 0.7 0.55 0.4 0.15 0.75 Required: Using the Minimax regret method choose the stock that will minimise your maximum regret

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts