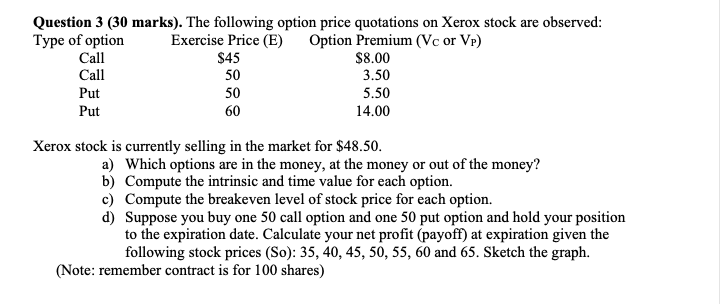

Question: Question 3 ( ( mathbf { 3 0 } ) marks ) . The following option price quotations on Xerox stock are

Question mathbf marks The following option price quotations on Xerox stock are observed: Type of option Exercise Price E Option Premium mathrmVmathrmC or mathrmVmathrmP Call $ $ Call Put Put Xerox stock is currently selling in the market for $ a Which options are in the money, at the money or out of the money? b Compute the intrinsic and time value for each option. c Compute the breakeven level of stock price for each option. d Suppose you buy one call option and one put option and hold your position to the expiration date. Calculate your net profit payoff at expiration given the following stock prices So: and Sketch the graph. Note: remember contract is for shares

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock