Question: Question (3) (Minimum Variance Frontier with many risky assets) (5 points) Suppose there are many risky securities (stocks) in the market. However, you are told

Question (3) (Minimum Variance Frontier with many risky assets) (5 points) Suppose there are many risky securities (stocks) in the market. However, you are told that there are two particularly interesting portfolios of (risky) stocks in the market: portfolios A and B.

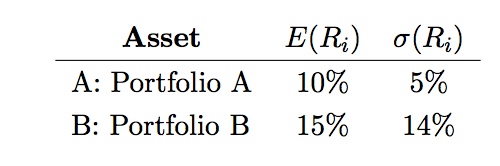

These two portfolios have the following characteristics

And you also know that the correlation between these two portfolios is 0:3. You also know that these two portfolios ARE on the minimum variance frontier..

(a) Can you construct the minimum variance frontier with the information provided? Why? (i.e. say the name of the theorem we discussed in class) 2

(b) Hopefully, you answered yes to the previous question. Sketch the minimum variance frontier of the market with the information provided. Which part of the minimum variance frontier is e cient? Why?

(c) If you didnt know that portfolios A and B were on the minimum variance frontier, do you think you would have been able to sketch the minimum variance frontier easily? (Just briey explain in words all the information/data that you would need to have in order to be able to compute/derive the minimum variance frontier)

Assets E (Ri) (Ri) A: Portfolio A 10% 5% B: Portfolio B 15% 14%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts