Question: QUESTION 3 Nigel purchased three new laptops from Cheap Computers Ltd for $ 4 9 9 each during a one - day sale. The laptops

QUESTION

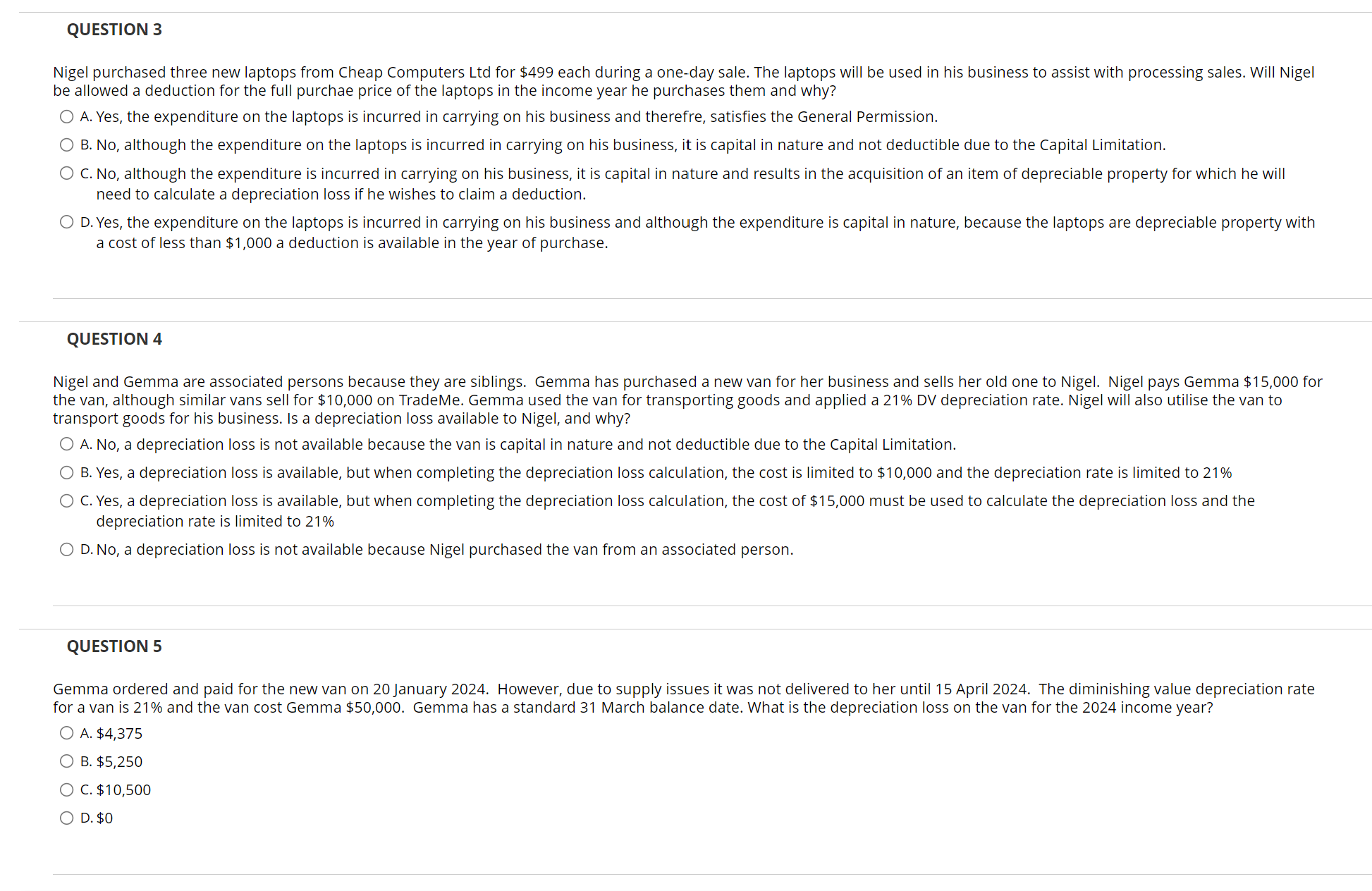

Nigel purchased three new laptops from Cheap Computers Ltd for $ each during a oneday sale. The laptops will be used in his business to assist with processing sales. Will Nigel

be allowed a deduction for the full purchae price of the laptops in the income year he purchases them and why?

A Yes, the expenditure on the laptops is incurred in carrying on his business and therefre, satisfies the General Permission.

B No although the expenditure on the laptops is incurred in carrying on his business, it is capital in nature and not deductible due to the Capital Limitation.

C No although the expenditure is incurred in carrying on his business, it is capital in nature and results in the acquisition of an item of depreciable property for which he will

need to calculate a depreciation loss if he wishes to claim a deduction.

D Yes, the expenditure on the laptops is incurred in carrying on his business and although the expenditure is capital in nature, because the laptops are depreciable property with

a cost of less than $ a deduction is available in the year of purchase.

QUESTION

Nigel and Gemma are associated persons because they are siblings. Gemma has purchased a new van for her business and sells her old one to Nigel. Nigel pays Gemma $ for

the van, although similar vans sell for $ on TradeMe. Gemma used the van for transporting goods and applied a DV depreciation rate. Nigel will also utilise the van to

transport goods for his business. Is a depreciation loss available to Nigel, and why?

A No a depreciation loss is not available because the van is capital in nature and not deductible due to the Capital Limitation.

B Yes, a depreciation loss is available, but when completing the depreciation loss calculation, the cost is limited to $ and the depreciation rate is limited to

C Yes, a depreciation loss is available, but when completing the depreciation loss calculation, the cost of $ must be used to calculate the depreciation loss and the

depreciation rate is limited to

D No a depreciation loss is not available because Nigel purchased the van from an associated person.

QUESTION

Gemma ordered and paid for the new van on January However, due to supply issues it was not delivered to her until April The diminishing value depreciation rate

for a van is and the van cost Gemma $ Gemma has a standard March balance date. What is the depreciation loss on the van for the income year?

A $

B $

C $

D $

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock