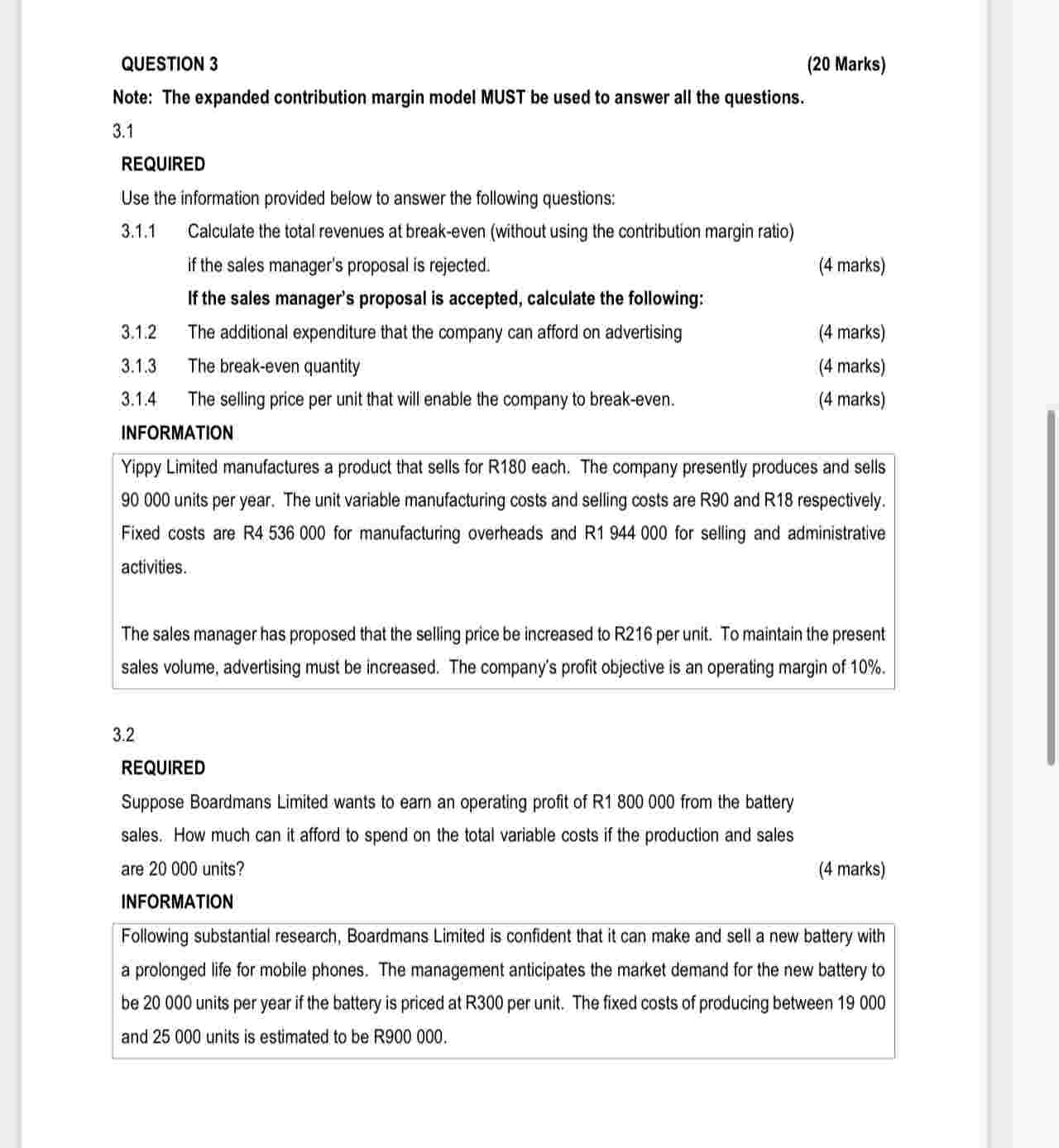

Question: QUESTION 3 Note: The expanded contribution margin model MUST be used to answer all the questions. 3 . 1 REQUIRED Use the information provided below

QUESTION Note: The expanded contribution margin model MUST be used to answer all the questions. REQUIRED Use the information provided below to answer the following questions: Calculate the total revenues at breakeven without using the contribution margin ratio if the sales manager's proposal is rejected. marks If the sales manager's proposal is accepted, calculate the following: The additional expenditure that the company can afford on advertising marks The breakeven quantity The selling price per unit that will enable the company to breakeven. INFORMATION Yippy Limited manufactures a product that sells for R each. The company presently produces and sells units per year. The unit variable manufacturing costs and selling costs are R and R respectively. Fixed costs are R for manufacturing overheads and R for selling and administrative activities. The sales manager has proposed that the selling price be increased to R per unit. To maintain the present sales volume, advertising must be increased. The company's profit objective is an operating margin of REQUIRED Suppose Boardmans Limited wants to earn an operating profit of R from the battery sales. How much can it afford to spend on the total variable costs if the production and sales are units? INFORMATION Following substantial research, Boardmans Limited is confident that it can make and sell a new battery with a prolonged life for mobile phones. The management anticipates the market demand for the new battery to be units per year if the battery is priced at R per unit. The fixed costs of producing between and units is estimated to be R

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock