Question: QUESTION 3 NOTE: This Question is 15 POINTS ALSO Be sure to put a (-) minus sign in your answer if appropriate Nike is expecting

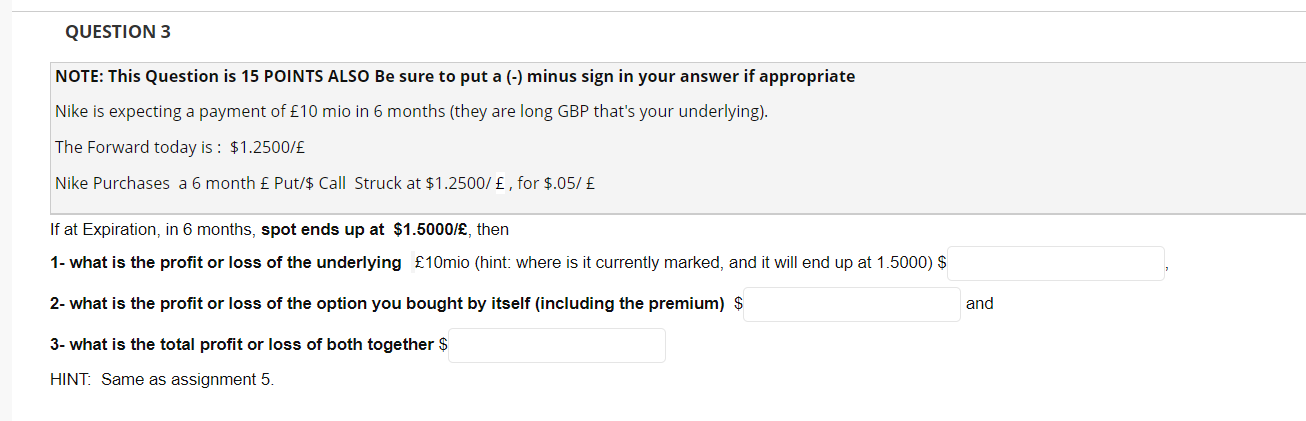

QUESTION 3 NOTE: This Question is 15 POINTS ALSO Be sure to put a (-) minus sign in your answer if appropriate Nike is expecting a payment of 10 mio in 6 months (they are long GBP that's your underlying). The Forward today is: $1.2500/ Nike Purchases a 6 month Put/$ Call Struck at $1.2500/, for $.05/ If at Expiration, in 6 months, spot ends up at $1.5000/, then 1- what is the profit or loss of the underlying 10mio (hint: where is it currently marked, and it will end up at 1.5000) $ 2- what is the profit or loss of the option you bought by itself (including the premium) $ and 3- what is the total profit or loss of both together $ HINT: Same as assignment 5. QUESTION 3 NOTE: This Question is 15 POINTS ALSO Be sure to put a (-) minus sign in your answer if appropriate Nike is expecting a payment of 10 mio in 6 months (they are long GBP that's your underlying). The Forward today is: $1.2500/ Nike Purchases a 6 month Put/$ Call Struck at $1.2500/, for $.05/ If at Expiration, in 6 months, spot ends up at $1.5000/, then 1- what is the profit or loss of the underlying 10mio (hint: where is it currently marked, and it will end up at 1.5000) $ 2- what is the profit or loss of the option you bought by itself (including the premium) $ and 3- what is the total profit or loss of both together $ HINT: Same as assignment 5

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts