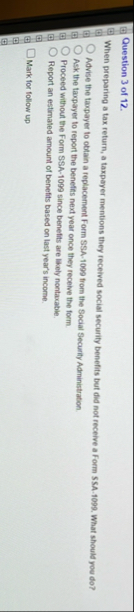

Question: Question 3 of 1 2 . When preparing a tax return, a taxpayer mentions they received social security benefits but did not receive a Form

Question of

When preparing a tax return, a taxpayer mentions they received social security benefits but did not receive a Form SSA What should you do

Advise the taxpayer to obtain a replacement Form SSA from the Social Security Administration.

Ask the taxpayer to report the benefits next year once they receive the form.

Proceed without the Form SSA since benefits are lickly nontacable.

Report an estimated amount of benefits based on last year's income.

Mark for follow up

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock