Question: Question 3 On 1 January 2 0 2 3 , Bello Ltd acquired an office building for R 2 5 0 0 0 0 0

Question

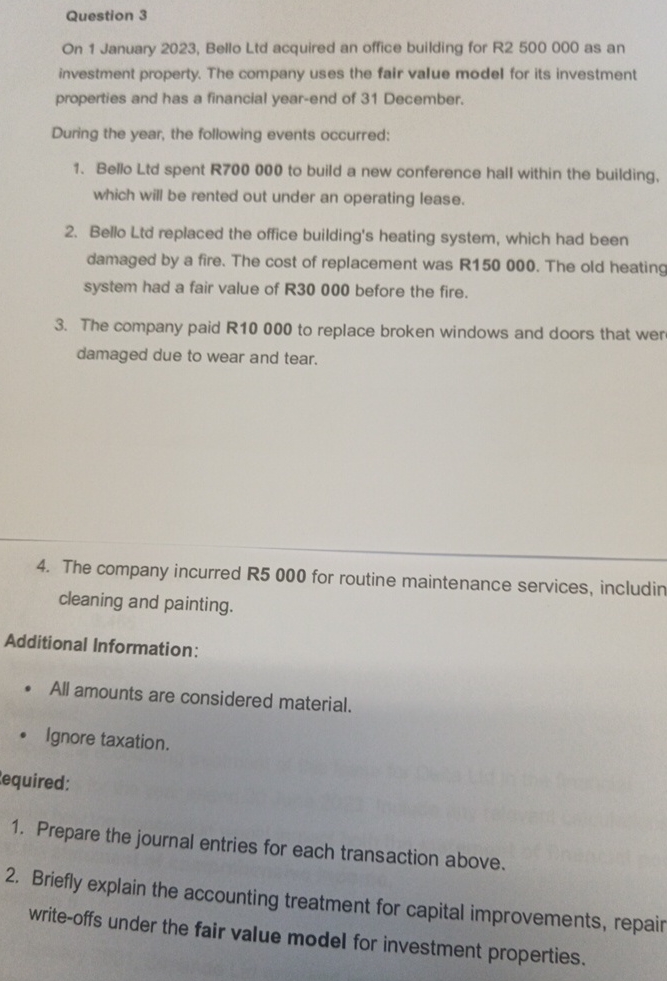

On January Bello Ltd acquired an office building for R as an investment property. The company uses the fair value model for its investment properties and has a financial yearend of December.

During the year, the following events occurred:

Bello Ltd spent R to build a new conference hall within the building. which will be rented out under an operating lease.

Bello Ltd replaced the office building's heating system, which had been damaged by a fire. The cost of replacement was R The old heating system had a fair value of R before the fire.

The company paid to replace broken windows and doors that wer damaged due to wear and tear.

The company incurred R for routine maintenance services, includin cleaning and painting.

Additional Information:

All amounts are considered material.

Ignore taxation.

equired:

Prepare the journal entries for each transaction above.

Briefly explain the accounting treatment for capital improvements, repair writeoffs under the fair value model for investment properties.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock