Question: QUESTION 3 On January 1, 2021, UAE Constructions Inc. signed a five-year non cancelable lease with Oman Equipment LLC. The lease value was fixed at

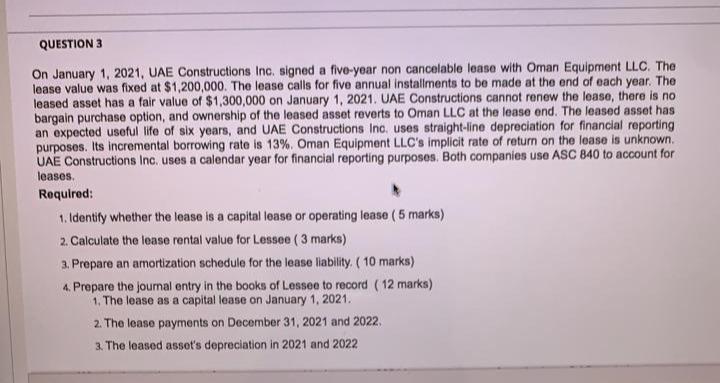

QUESTION 3 On January 1, 2021, UAE Constructions Inc. signed a five-year non cancelable lease with Oman Equipment LLC. The lease value was fixed at $1,200,000. The lease calls for five annual installments to be made at the end of each year. The leased asset has a fair value of $1,300,000 on January 1, 2021. UAE Constructions cannot renew the lease, there is no bargain purchase option, and ownership of the leased asset reverts to Oman LLC at the lease end. The leased asset has an expected useful life of six years, and UAE Constructions Inc. uses straight-line depreciation for financial reporting purposes. Its incremental borrowing rate is 13% Oman Equipment LLC's implicit rate of return on the lease is unknown UAE Constructions Inc, uses a calendar year for financial reporting purposes. Both companies use ASC 840 to account for leases Required: 1. Identify whether the lease is a capital lease or operating lease ( 5 marks) 2. Calculate the lease rental value for Lessee ( 3 marks) 3. Prepare an amortization schedule for the lease liability. (10 marks) 4. Prepare the journal entry in the books of Lessee to record (12 marks) 1. The lease as a capital lease on January 1, 2021. 2. The lease payments on December 31, 2021 and 2022 3. The leased asset's depreciation in 2021 and 2022

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts