Question: QUESTION 3 Parent Ltd acquired all the equity in Sub Ltd on 1 April 2004 for $1 000 000. Sub Ltd had disclosed a contingent

QUESTION 3

Parent Ltd acquired all the equity in Sub Ltd on 1 April 2004 for $1 000 000. Sub Ltd had disclosed a contingent liability of $30 000 and an unrecognised intangible asset of $45 000. The equity of Sub Ltd on 1 April 2004 comprised:

| Share capital | $600 000 |

| Retained earnings (REs) | 130 000 |

| Asset revaluation surplus (ARS) | 200 000 |

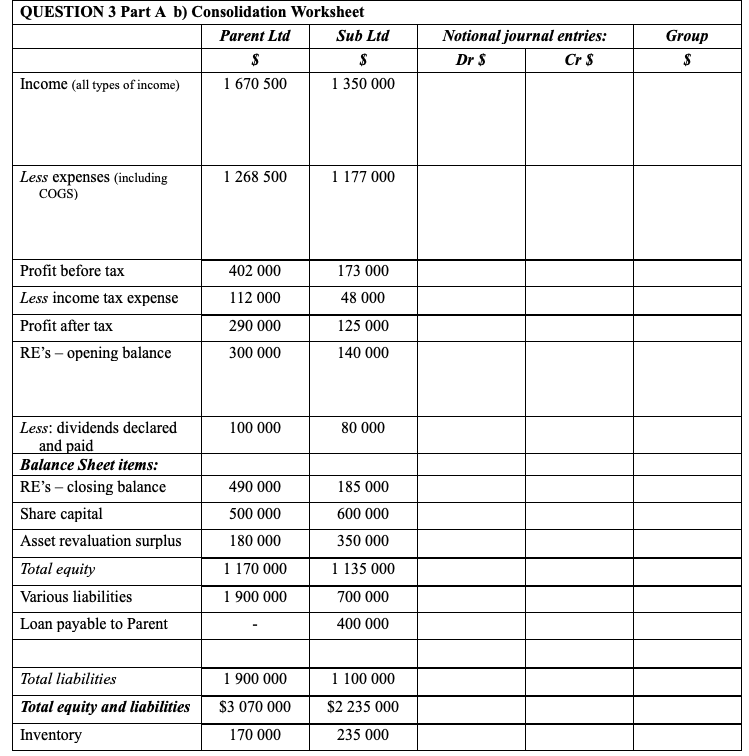

Financial information, of Parent Ltd and Sub Ltd, for the year ended 31 March 2021,

follows:

| Parent Ltd | Sub Ltd | |

| $ | $ | |

| Income (all types of income) | 1 670 500 | 1 350 000 |

| Less expenses (including COGS) | 1 268 500 | 1 177 000 |

| Profit before tax | 402 000 | 173 000 |

| Less income tax expense | 112 000 | 48 000 |

| Profit after tax | 290 000 | 125 000 |

| REs opening balance | 300 000 | 140 000 |

| Less: dividends declared and paid | 100 000 | 80 000 |

| Balance Sheet items: | ||

| REs closing balance | 490 000 | 185 000 |

| Share capital | 500 000 | 600 000 |

| Asset revaluation surplus | 180 000 | 350 000 |

| Total equity | 1 170 000 | 1 135 000 |

| Various liabilities | 1 900 000 | 700 000 |

| Loan payable to Parent | - | 400 000 |

| Total liabilities | 1 900 000 | 1 100 000 |

| Total equity and liabilities | $3 070 000 | $2 235 000 |

| Inventory | 170 000 | 235 000 |

| Various assets | 1 500 000 | 2 000 000 |

| Loan receivable from Sub | 400 000 | - |

| Investment in Sub Ltd | 1 000 000 | - |

| Total assets | $3 070 000 | $2 235 000 |

Question 3 continued:

Parent Ltd's newly appointed junior accountant has been asked to prepare the draft consolidated financial statements for the year ended 31 March 2021. She has asked you for your expert help.

At your request, the following information was obtained:

(i) Five years ago, Sub Ltd obtained a loan from Parent Ltd. During the current financial year, Sub Ltd paid $15 000 of interest which related to this year. An additional $6 000 interest on this loan, relating to this financial year, is outstanding at balance date.

(ii) During March 2020, Sub Ltd made sales to Parent Ltd of $20 000 and recognised a profit of $5 000. This purchase remained in the inventory of Parent Ltd as at 31 March 2020.

(iii) On 4 March 2021, Sub Ltd made sales to Parent Ltd of $25 000 and recognised a profit of $6 200. Parent Ltd sold this purchase of inventory to Tan Ltd on 12 April 2021.

(v) During February 2021, Parent Ltd made sales to Sub Ltd of $13 000 and recognised a profit of $3 200. Sub Ltd sold this purchase of inventory to Kazey Ltd on 30 March 2021.

(vi) Prior years impairment of total goodwill amounted to $16 000. For the current year ended 31 March 2021, the directors of Parent Ltd believe that the total goodwill has been further impaired by $4 000.

PART A Required:

a) Prepare the notional journal entries, with detailed workings, in order to consolidate Parent Ltd and Sub Ltd in accordance with the requirements of NZ IFRS 3 Business Combinations and NZ IFRS 10 Consolidated Financial Statements, for the year ended 31 March 2021.

b) Prepare a consolidation worksheet for Parent Ltd, in accordance with the requirements of NZ IFRS 3 Business Combinations and NZ IFRS 10 Consolidated Financial Statements, for the year ended 31 March 2021.

c) Explain why the Parent Ltds asset Investment in Sub Ltd would not be included in the

Group Financial Statements.

d) Explain, by referring to the relevant accounting standards, why the Group recognised a

Sub related contingent liability but Sub Ltd did not.

Question 3 continued:

PART B

Assume Parent Ltd acquired 60% of the equity of Sub Ltd on 1 April 2004. The acquisition consideration consisted of $516 000 cash and the issue of 60 000 Parent Ltd shares. The Parent Ltd shares had a market value of $1.40 on the date of acquisition.

Required:

a) Prepare the notional journal entry at 31 March 2021 to identify the non-controlling interest (NCI), in Sub Ltd, to be reported in the group accounts in accordance with NZ IFRS 10 Consolidated Financial Statements and NZ IFRS 3 Business Combinations. The directors of Parent Ltd require the NCI in Sub Ltd to be measured at fair value. All workings must be included on each line of your notional journal entry.

b) Paragraph 19 of NZ IFRS 3 Business Combinations provides a choice of measurement for the non-controlling interest (NCI) in the acquiree. Prepare a reconciliation between the NCI measured at fair value (as per your answer above) and the measurement of the NCI using the alternative measurement basis, i.e., at the proportionate share in the recognised amounts of the subsidiarys identifiable net assets.

c) Which shareholders will receive the acquisition consideration of cash and Parent Ltd shares?

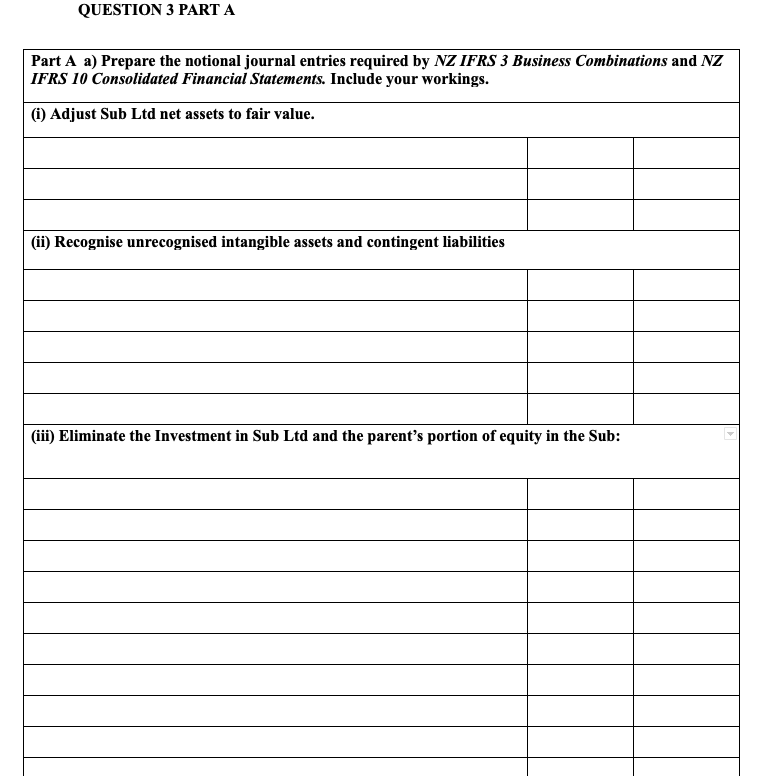

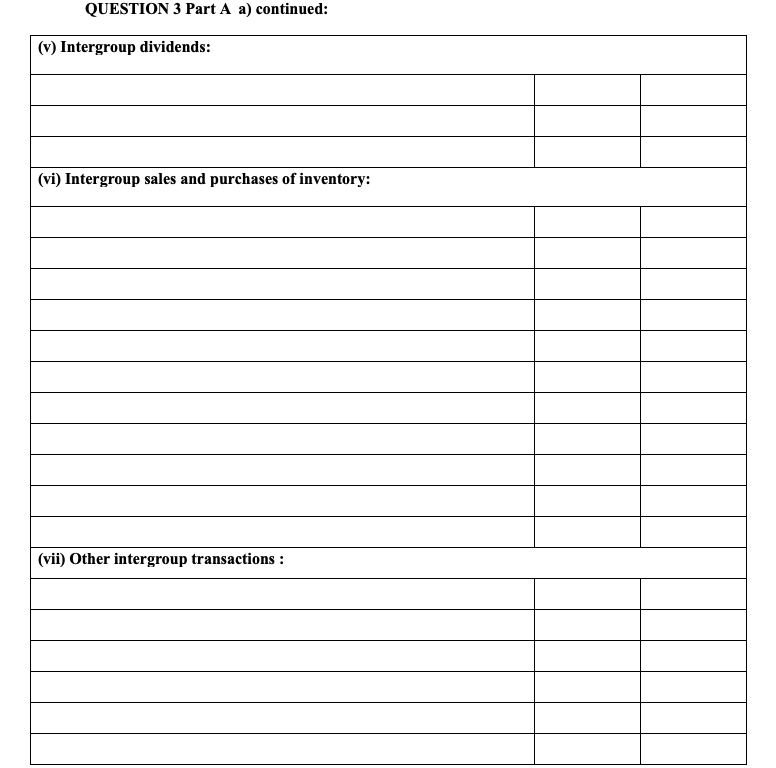

QUESTION 3 PART A Part A a) Prepare the notional journal entries required by NZ IFRS 3 Business Combinations and NZ IFRS 10 Consolidated Financial Statements. Include your workings. (i) Adjust Sub Ltd net assets to fair value. (ii) Recognise unrecognised intangible assets and contingent liabilities (iii) Eliminate the Investment in Sub Ltd and the parent's portion of equity in the Sub: QUESTION 3 Part A a) continued: (v) Intergroup dividends: (vi) Intergroup sales and purchases of inventory: (vii) Other intergroup transactions : QUESTION 3 Part A b) Consolidation Worksheet Parent Ltd Sub Ltd $ $ Income (all types of income) 1 670 500 1 350 000 1 268 500 1 177 000 Less expenses (including COGS) Profit before tax 402 000 173 000 Less income tax expense 112 000 48 000 Profit after tax 290 000 125 000 RE's - opening balance 300 000 140 000 Less: dividends declared 100 000 80 000 and paid Balance Sheet items: RE's closing balance 490 000 185 000 Share capital 500 000 600 000 Asset revaluation surplus 180 000 350 000 Total equity 1 170 000 1 135 000 Various liabilities 1 900 000 700 000 400 000 Loan payable to Parent Total liabilities 1 900 000 1 100 000 Total equity and liabilities $3 070 000 $2 235 000 Inventory 170 000 235 000 Notional journal entries: Cr $ Dr S Group $

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts