Question: Question 3 Part (A) Hedging Using Index Futures (15%) Assume that you are managing a portfolio tracking the S&P index. The value of your portfolio

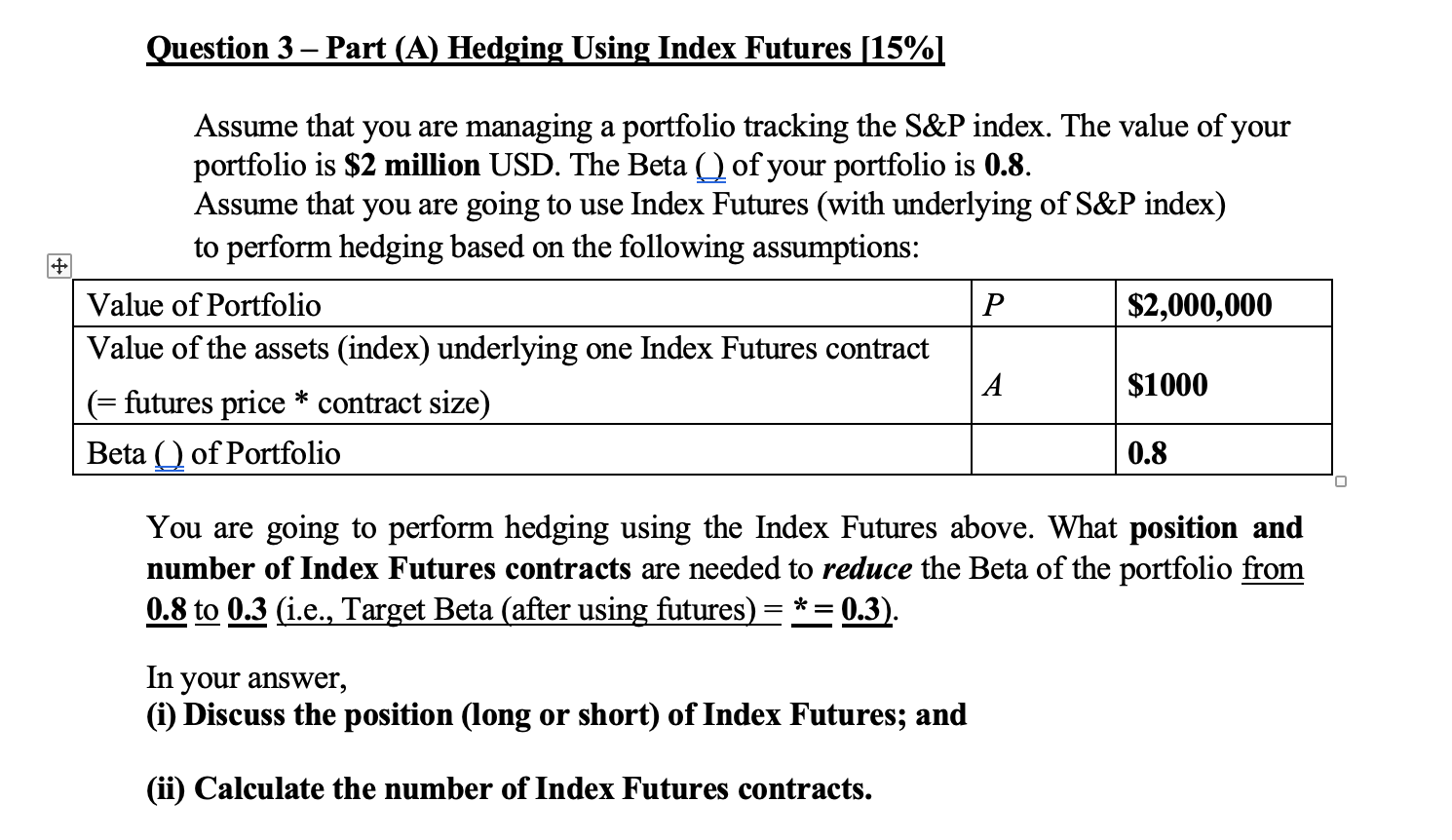

Question 3 Part (A) Hedging Using Index Futures (15%) Assume that you are managing a portfolio tracking the S&P index. The value of your portfolio is $2 million USD. The Beta Q of your portfolio is 0.8. Assume that you are going to use Index Futures (with underlying of S&P index) to perform hedging based on the following assumptions: Value of Portfolio P $2,000,000 Value of the assets (index) underlying one Index Futures contract A $1000 (= futures price * contract size) Beta () of Portfolio 0.8 You are going to perform hedging using the Index Futures above. What position and number of Index Futures contracts are needed to reduce the Beta of the portfolio from 0.8 to 0.3 (i.e., Target Beta (after using futures) = *= = 0.3). In your answer, (i) Discuss the position (long or short) of Index Futures; and (ii) Calculate the number of Index Futures contracts

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts