Question: Question 3 : Paul, a retiree aged 6 0 , has an investment pool of HK $ 1 , 0 0 0 , 0 0

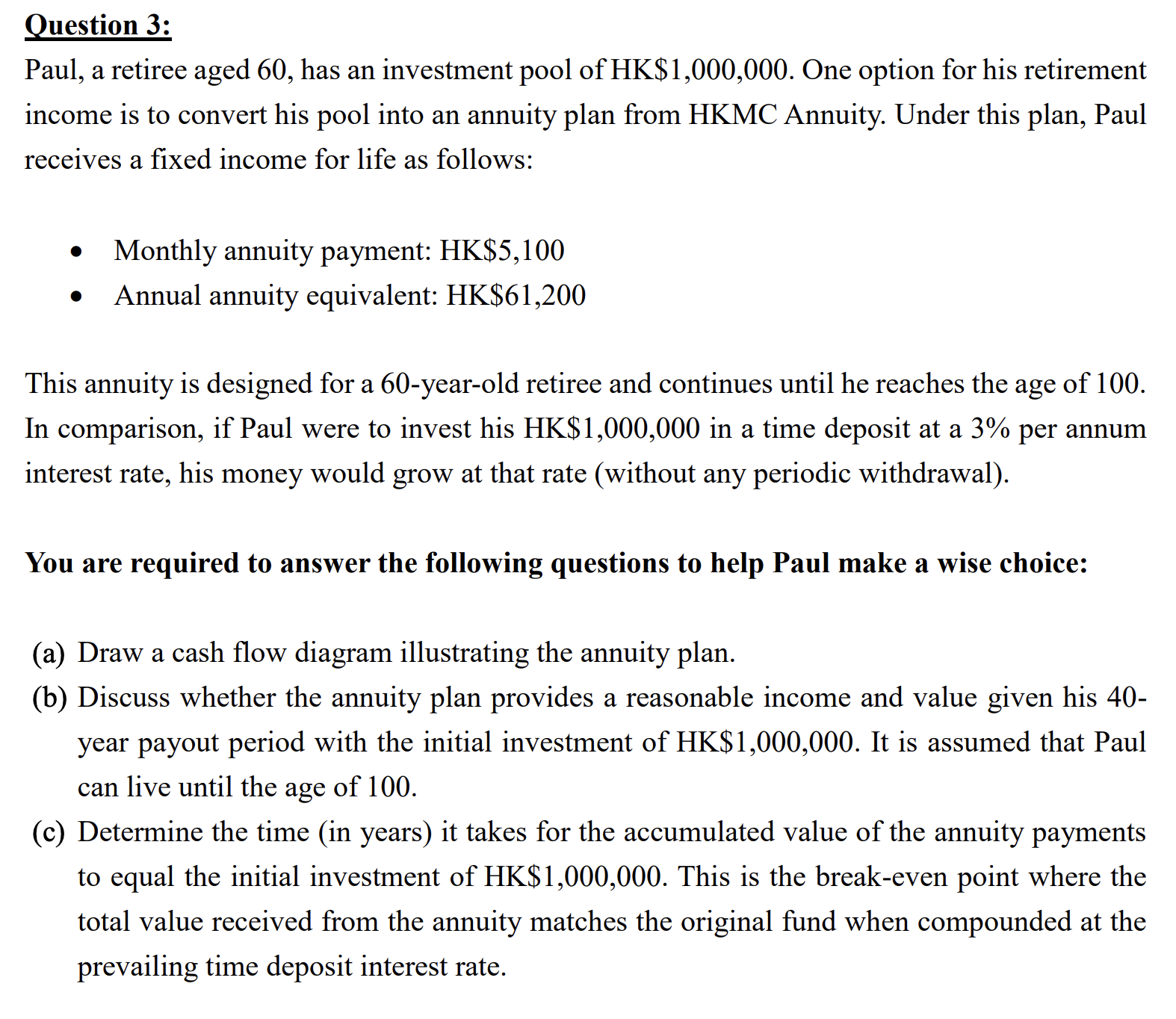

Question : Paul, a retiree aged has an investment pool of HK $ One option for his retirement income is to convert his pool into an annuity plan from HKMC Annuity. Under this plan, Paul receives a fixed income for life as follows: Monthly annuity payment: HK $ Annual annuity equivalent: HK $ This annuity is designed for a yearold retiree and continues until he reaches the age of In comparison, if Paul were to invest his HK $ in a time deposit at a per annum interest rate, his money would grow at that rate without any periodic withdrawal You are required to answer the following questions to help Paul make a wise choice: a Draw a cash flow diagram illustrating the annuity plan. b Discuss whether the annuity plan provides a reasonable income and value given his year payout period with the initial investment of HK $ It is assumed that Paul can live until the age of c Determine the time in years it takes for the accumulated value of the annuity payments to equal the initial investment of HK$ This is the breakeven point where the total value received from the annuity matches the original fund when compounded at the prevailing time deposit interest rate.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock