Question: Question #3 Phyllis age 43 with an 50% MTR has a few planning issues she has approached you about. Phyllis's mortgage is renewing this month

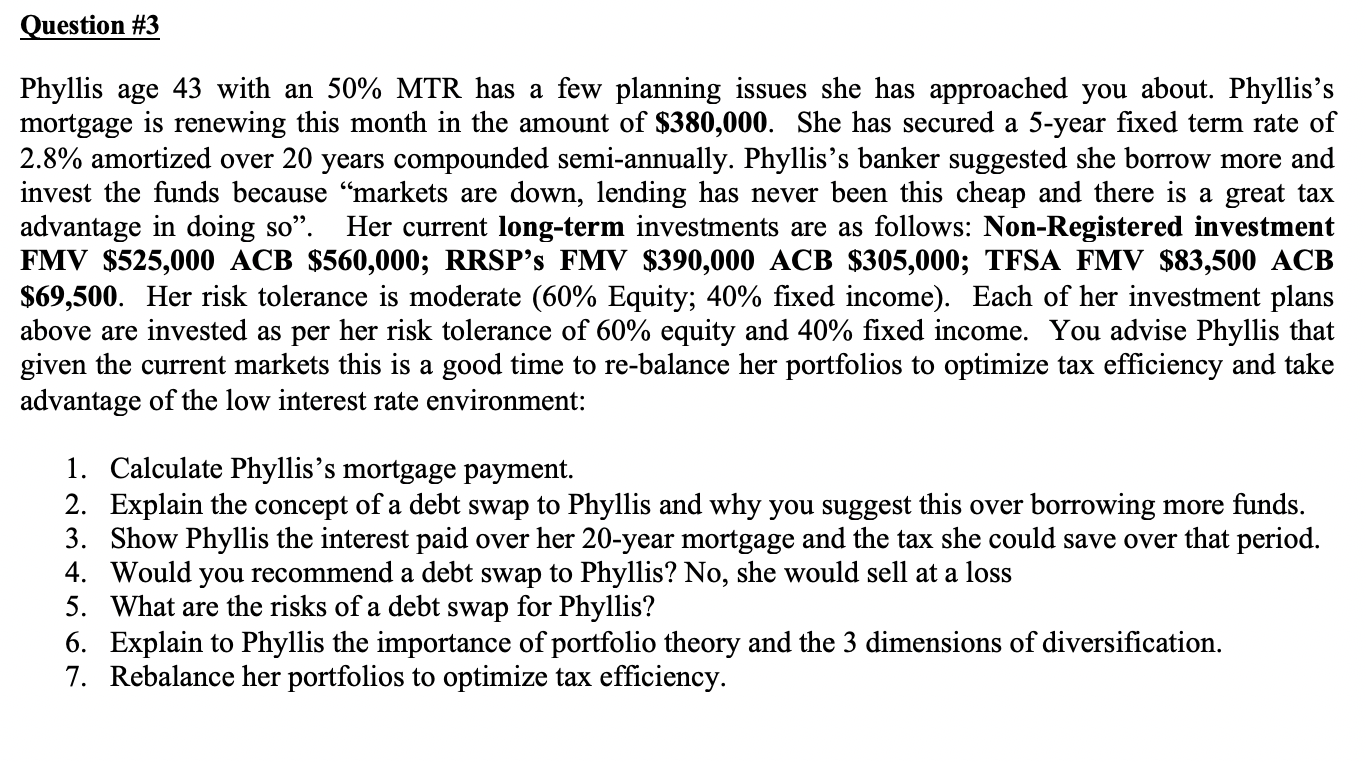

Question #3 Phyllis age 43 with an 50% MTR has a few planning issues she has approached you about. Phyllis's mortgage is renewing this month in the amount of $380,000. She has secured a 5-year fixed term rate of 2.8% amortized over 20 years compounded semi-annually. Phyllis's banker suggested she borrow more and invest the funds because markets are down, lending has never been this cheap and there is a great tax advantage in doing so. Her current long-term investments are as follows: Non-Registered investment FMV $525,000 ACB $560,000; RRSP's FMV $390,000 ACB $305,000; TFSA FMV $83,500 ACB $69,500. Her risk tolerance is moderate (60% Equity; 40% fixed income). Each of her investment plans above are invested as per her risk tolerance of 60% equity and 40% fixed income. You advise Phyllis that given the current markets this is a good time to re-balance her portfolios to optimize tax efficiency and take advantage of the low interest rate environment: 1. Calculate Phyllis's mortgage payment. 2. Explain the concept of a debt swap to Phyllis and why you suggest this over borrowing more funds. 3. Show Phyllis the interest paid over her 20-year mortgage and the tax she could save over that period. 4. Would you recommend a debt swap to Phyllis? No, she would sell at a loss 5. What are the risks of a debt swap for Phyllis? 6. Explain to Phyllis the importance of portfolio theory and the 3 dimensions of diversification. 7. Rebalance her portfolios to optimize tax efficiency Question #3 Phyllis age 43 with an 50% MTR has a few planning issues she has approached you about. Phyllis's mortgage is renewing this month in the amount of $380,000. She has secured a 5-year fixed term rate of 2.8% amortized over 20 years compounded semi-annually. Phyllis's banker suggested she borrow more and invest the funds because markets are down, lending has never been this cheap and there is a great tax advantage in doing so. Her current long-term investments are as follows: Non-Registered investment FMV $525,000 ACB $560,000; RRSP's FMV $390,000 ACB $305,000; TFSA FMV $83,500 ACB $69,500. Her risk tolerance is moderate (60% Equity; 40% fixed income). Each of her investment plans above are invested as per her risk tolerance of 60% equity and 40% fixed income. You advise Phyllis that given the current markets this is a good time to re-balance her portfolios to optimize tax efficiency and take advantage of the low interest rate environment: 1. Calculate Phyllis's mortgage payment. 2. Explain the concept of a debt swap to Phyllis and why you suggest this over borrowing more funds. 3. Show Phyllis the interest paid over her 20-year mortgage and the tax she could save over that period. 4. Would you recommend a debt swap to Phyllis? No, she would sell at a loss 5. What are the risks of a debt swap for Phyllis? 6. Explain to Phyllis the importance of portfolio theory and the 3 dimensions of diversification. 7. Rebalance her portfolios to optimize tax efficiency

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts