Question: Question #3 Pittman Laboratory Inc . commenced operations in 2016. At the end of their first fiscal year, December 31, 2016, the Shareholders Equity of

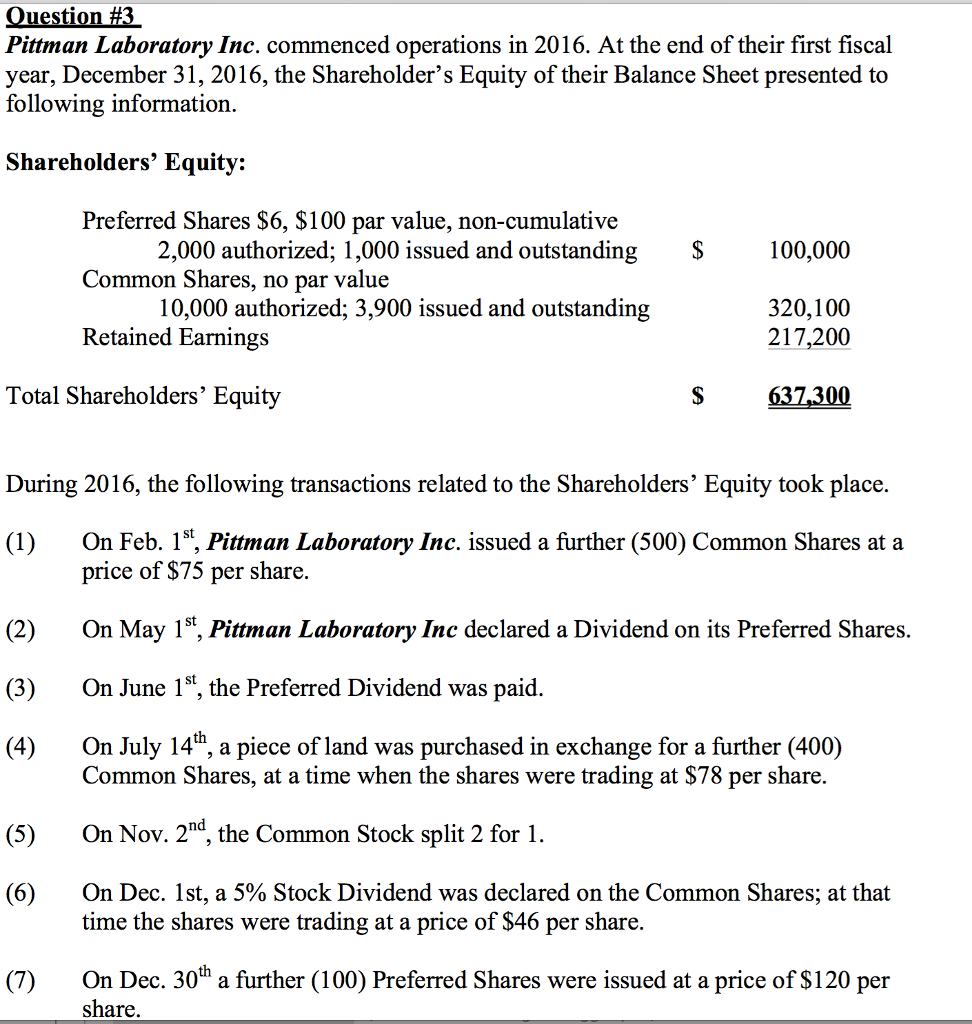

Question #3

Pittman Laboratory Inc. commenced operations in 2016. At the end of their first fiscal year, December 31, 2016, the Shareholders Equity of their Balance Sheet presented to following information.

Shareholders Equity:

Preferred Shares $6, $100 par value, non-cumulative 2,000 authorized; 1,000 issued and outstanding $

Common Shares, no par value 10,000 authorized; 3,900 issued and outstanding

Retained Earnings Total Shareholders Equity $

100,000

320,100 217,200

637,300

During 2016, the following transactions related to the Shareholders Equity took place.

(1) On Feb. 1st, Pittman Laboratory Inc. issued a further (500) Common Shares at a price of $75 per share.

(2) On May 1st, Pittman Laboratory Inc declared a Dividend on its Preferred Shares.

(3) On June 1st, the Preferred Dividend was paid.

(4) On July 14th, a piece of land was purchased in exchange for a further (400) Common Shares, at a time when the shares were trading at $78 per share.

(5) On Nov. 2nd, the Common Stock split 2 for 1.

(6) On Dec. 1st, a 5% Stock Dividend was declared on the Common Shares; at that time the shares were trading at a price of $46 per share.

(7) On Dec. 30th a further (100) Preferred Shares were issued at a price of $120 per share.

Required:

(A) Prepare Journal Entries for each of the transactions listed above.

(B) Assuming that Pittman Laboratory Inc. Net Income (after taxes) for 2016 was $130,000, prepare the Shareholders Equity section of the Balance Sheet as at December 31, 2015.

(C) Discuss why Pittman Laboratory Inc. may have declared a Common Stock Split on Nov. 2nd?

(D) What is the significance of the Preferred Shares in relation to declaring Dividends on the Common Shares?

Pittman Laboratory Inc. commenced operations in 2016. At the end of their first fiscal year, December 31, 2016, the Shareholder's Equity of their Balance Sheet presented to following information Shareholders' Equity: Preferred Shares S6, S100 par value, non-cumulative Common Shares, no par value Retained Earnings 2,000 authorized; 1,000 issued and outstandingS 100,000 10,000 authorized; 3,900 issued and outstanding 320,100 217,200 Total Shareholders' Equity S637300 During 2016, the following transactions related to the Shareholders' Equity took place. (1) On Feb. 1s, Pittman Laboratory Inc. issued a further (500) Common Shares at a price of $75 per share (2) On May 1St, Pittman Laboratory Inc declared a Dividend on its Preferred Shares. (3) On June 1St, the Preferred Dividend was paid (4) On July 14", a piece of land was purchased in exchange for a further (400) th Common Shares, at a time when the shares were trading at S78 per share On Nov. 2"d, the Common Stock split 2 for 1 On Dec. 1st, a 5% Stock Dividend was declared on the Common Shares, at that (5) (6) time the shares were trading at a price of $46 per share. (7) On Dec. 30h a further (100) Preferred Shares were issued at a price of $120 per share

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts