Question: question 3 please! 1. Assume the inverse demand function for the depletable resource is P=80.4q and the marginal cost of supplying it is $2. (a)

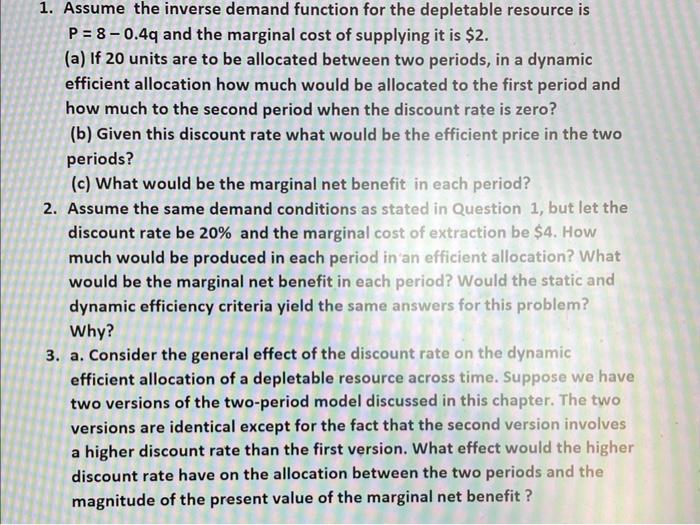

1. Assume the inverse demand function for the depletable resource is P=80.4q and the marginal cost of supplying it is $2. (a) If 20 units are to be allocated between two periods, in a dynamic efficient allocation how much would be allocated to the first period and how much to the second period when the discount rate is zero? (b) Given this discount rate what would be the efficient price in the two periods? (c) What would be the marginal net benefit in each period? 2. Assume the same demand conditions as stated in Question 1 , but let the discount rate be 20% and the marginal cost of extraction be $4. How much would be produced in each period in 'an efficient allocation? What would be the marginal net benefit in each period? Would the static and dynamic efficiency criteria yield the same answers for this problem? Why? 3. a. Consider the general effect of the discount rate on the dynamic efficient allocation of a depletable resource across time. Suppose we have two versions of the two-period model discussed in this chapter. The two versions are identical except for the fact that the second version involves a higher discount rate than the first version. What effect would the higher discount rate have on the allocation between the two periods and the magnitude of the present value of the marginal net benefit

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts