Question: Question 3 Please answer the following questions based on the income statement provided below: (1) What was the total amount of direct expenses (including

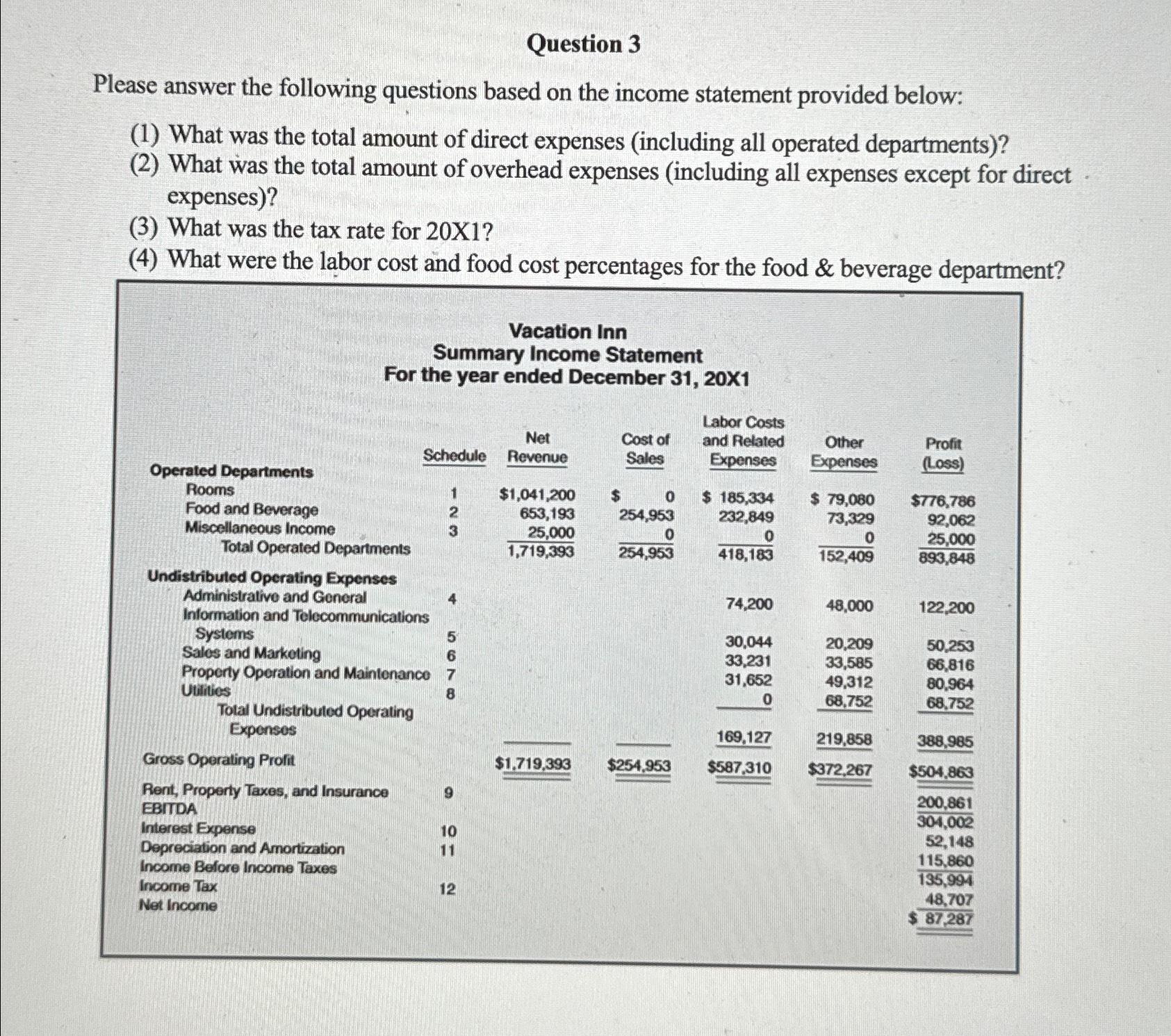

Question 3 Please answer the following questions based on the income statement provided below: (1) What was the total amount of direct expenses (including all operated departments)? (2) What was the total amount of overhead expenses (including all expenses except for direct expenses)? (3) What was the tax rate for 20X1? (4) What were the labor cost and food cost percentages for the food & beverage department? Operated Departments Rooms Food and Beverage Miscellaneous Income Vacation Inn Summary Income Statement For the year ended December 31, 20X1 Total Operated Departments Undistributed Operating Expenses Administrative and General Schedule Gross Operating Profit Rent, Property Taxes, and Insurance EBITDA Interest Expense Depreciation and Amortization Income Before Income Taxes Income Tax Net Income 1 Information and Telecommunications Systems Sales and Marketing Property Operation and Maintenance 7 Utilities Total Undistributed Operating Expenses 5678 10 11 12 Net Revenue $1,041,200 653,193 25,000 1,719,393 $1,719,393 Cost of Sales $ 0 254,953 254,953 Labor Costs and Related Expenses $ 185,334 232,849 0 418,183 74,200 30,044 33,231 31,652 0 Other Expenses $ 79,080 73,329 0 152,409 48,000 20,209 33,585 49,312 68,752 169,127 219,858 $254,953 $587,310 $372,267 Profit (Loss) $776,786 92,062 25,000 893,848 122,200 50,253 66,816 80,964 68,752 388,985 $504,863 200,861 304,002 52,148 115,860 135,994 48,707 $87,287

Step by Step Solution

3.43 Rating (159 Votes )

There are 3 Steps involved in it

Answer 1 Total amount of direct expenses including all operated departments Total direct expenses La... View full answer

Get step-by-step solutions from verified subject matter experts