Question: Question 3, please. Question 1 1 pts Use the following data for Question#1 to Question#5. The index model is estimated for the following two stocks.

Question 3,

please.

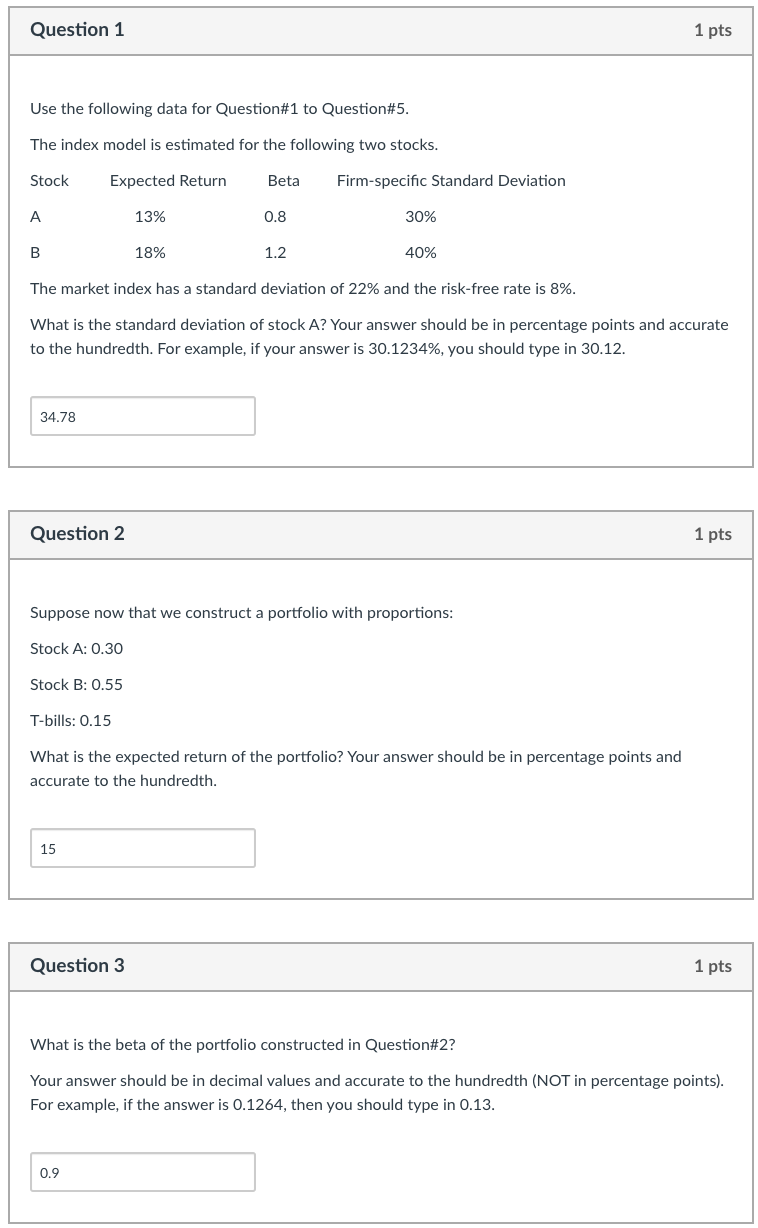

Question 1 1 pts Use the following data for Question#1 to Question#5. The index model is estimated for the following two stocks. Stock Expected Return Beta Firm-specific Standard Deviation A 13% 0.8 30% B 18% 1.2 40% The market index has a standard deviation of 22% and the risk-free rate is 8%. What is the standard deviation of stock A? Your answer should be in percentage points and accurate to the hundredth. For example, if your answer is 30.1234%, you should type in 30.12. 34.78 Question 2 1 pts Suppose now that we construct a portfolio with proportions: Stock A: 0.30 Stock B: 0.55 T-bills: 0.15 What is the expected return of the portfolio? Your answer should be in percentage points and accurate to the hundredth. 15 Question 3 1 pts What is the beta of the portfolio constructed in Question#2? Your answer should be in decimal values and accurate to the hundredth (NOT in percentage points). For example, if the answer is 0.1264, then you should type in 0.13. 0.9

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts