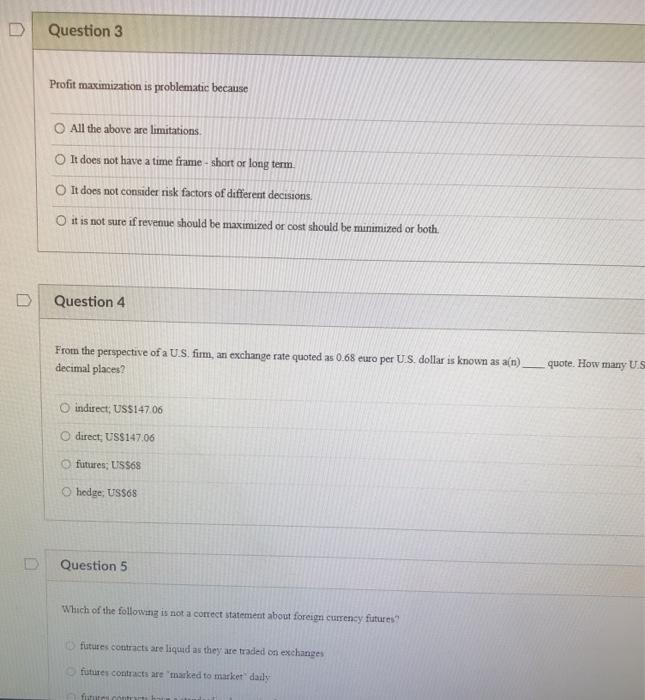

Question: Question 3 Profit maximization is problematic because All the above are limitations It does not have a time frame - short or long term It

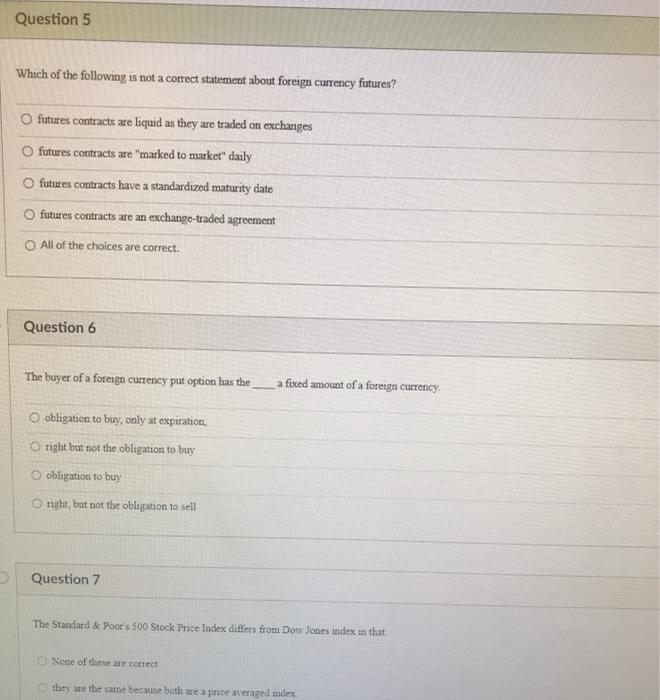

Question 3 Profit maximization is problematic because All the above are limitations It does not have a time frame - short or long term It does not consider risk factors of different decisions it is not sure if revenue should be maximized or cost should be minimized or both. Question 4 From the perspective of a U.S. firm, an exchange rate quoted as 0.68 euro per U.S. dollar is known as an) decimal places? quote. How many US O indirect: US$147.06 direct, US$147.06 futures: US$68 O hedge, US$68 Question 5 Which of the following is not a correct statement about foreign currency futures? futures contracts are liquid as they are traded on exchanges future contracts are marked to market daily fututub Question 5 Which of the following is not a correct statement about foreign currency futures? fitures contracts are liquid as they are traded on exchanges O futures contracts are "marked to market" daily O futures contracts have a standardized maturity date futures contracts are an exchange-traded agreement All of the choices are correct. Question 6 The buyer of a foreign currency put option has the a fixed amount of a foreign currency obligation to buy, only at expiration, Oright but not the obligation to buy obligation to buy right, but not the obligation to sell Question 7 The Standard & Poor's 500 Stock Price Index differs from Dow Jones index in that None of these are correct they are the same because both are a price averaged index

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts