Question: Question 3 Question 1 You are considering two projects. Project A has projected cash flows of $6,500, $4,500, and $2,500 for the next three years,

Question 3

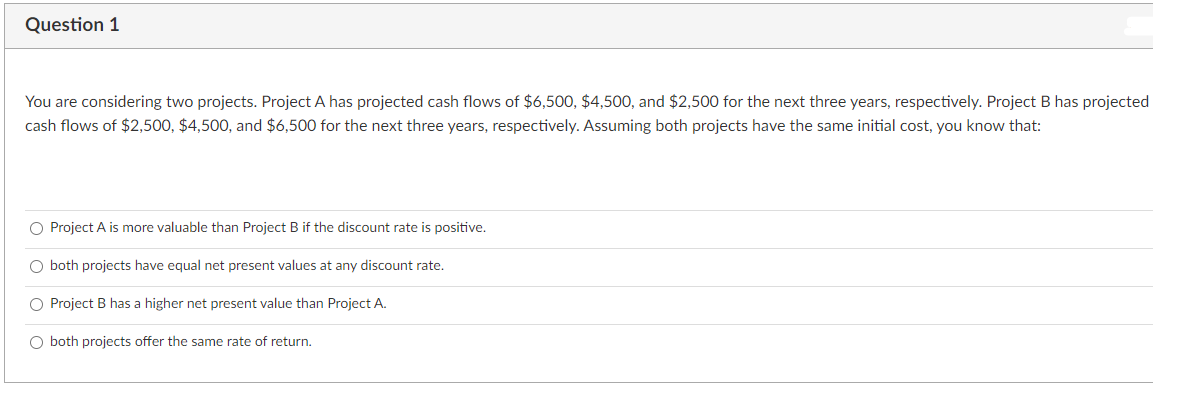

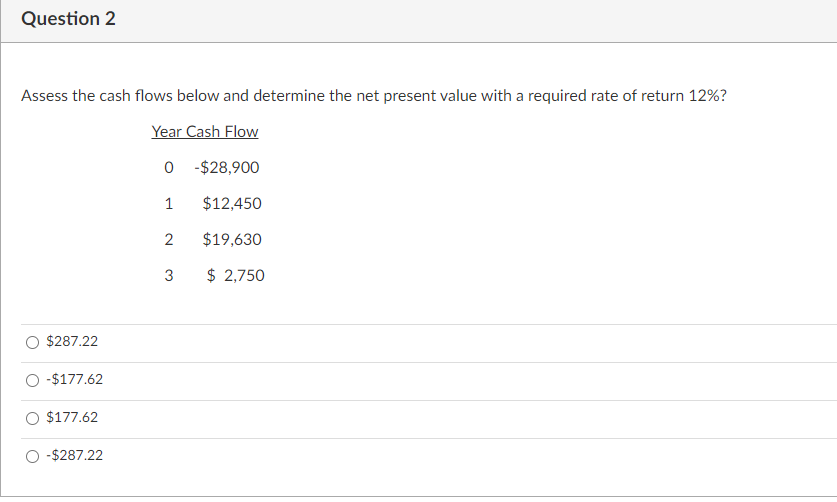

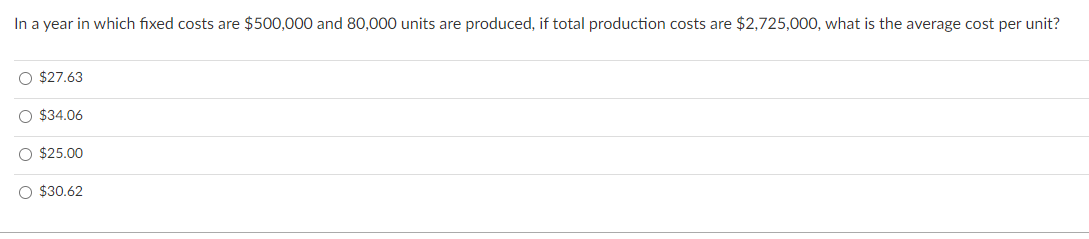

Question 1 You are considering two projects. Project A has projected cash flows of $6,500, $4,500, and $2,500 for the next three years, respectively. Project B has projected cash flows of $2,500, $4,500, and $6,500 for the next three years, respectively. Assuming both projects have the same initial cost, you know that: O Project A is more valuable than Project B if the discount rate is positive. O both projects have equal net present values at any discount rate. Project B has a higher net present value than Project A. both projects offer the same rate of return. Question 2 Assess the cash flows below and determine the net present value with a required rate of return 12%? Year Cash Flow 0 - $28,900 1 $12,450 2 $19,630 3 $ 2,750 $287.22 -$177.62 $177.62 -$287.22 In a year in which fixed costs are $500,000 and 80,000 units are produced, if total production costs are $2,725,000, what is the average cost per unit? O $27.63 $34.06 O $25.00 O $30.62

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts