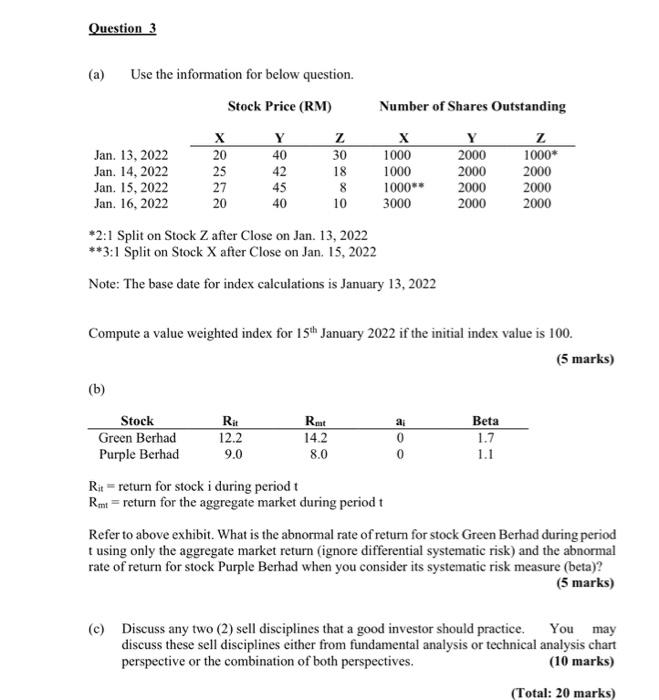

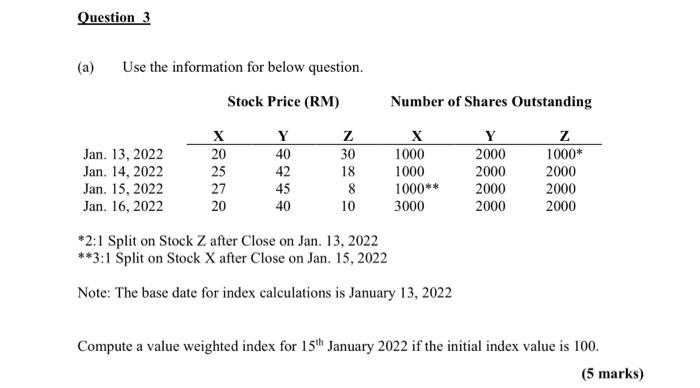

Question: question 3 Question 3 (a) Use the information for below question. Stock Price (RM) Number of Shares Outstanding Y 2000 2000 2000 2000 z 1000*

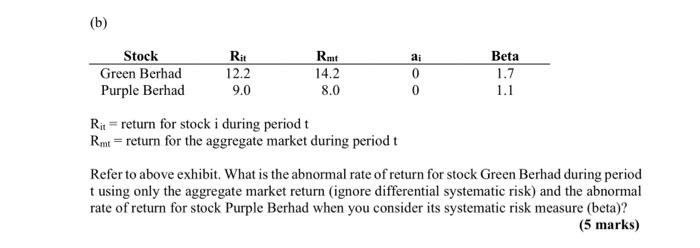

Question 3 (a) Use the information for below question. Stock Price (RM) Number of Shares Outstanding Y 2000 2000 2000 2000 z 1000* 2000 2000 2000 X Y Z Jan. 13, 2022 20 40 30 1000 Jan. 14, 2022 25 42 18 1000 Jan 15, 2022 27 45 8 1000** Jan. 16, 2022 20 40 10 3000 *2:1 Split on Stock Z after Close on Jan. 13, 2022 **3:1 Split on Stock X after Close on Jan. 15, 2022 Note: The base date for index calculations is January 13, 2022 Compute a value weighted index for 15th January 2022 if the initial index value is 100. (5 marks) (b) Stock Green Berhad Purple Berhad Rit 12.2 9.0 Rmt 14.2 8.0 OOP Beta 1.7 1.1 0 Rit - return for stock i during period t Rmt = return for the aggregate market during period t Refer to above exhibit. What is the abnormal rate of return for stock Green Berhad during period t using only the aggregate market return (ignore differential systematic risk) and the abnormal rate of return for stock Purple Berhad when you consider its systematic risk measure (beta)? (5 marks) (c) Discuss any two (2) sell disciplines that a good investor should practice. You may discuss these sell disciplines either from fundamental analysis or technical analysis chart perspective or the combination of both perspectives. (10 marks) (Total: 20 marks) Question 3 (a) Use the information for below question. Stock Price (RM) Number of Shares Outstanding Jan. 13, 2022 Jan. 14, 2022 Jan. 15, 2022 Jan. 16, 2022 X 20 25 27 20 Y 40 42 45 40 z 30 18 8 10 X 1000 1000 1000** 3000 Y 2000 2000 2000 2000 z 1000* 2000 2000 2000 *2:1 Split on Stock Z after Close on Jan. 13, 2022 **3:1 Split on Stock X after Close on Jan. 15, 2022 Note: The base date for index calculations is January 13, 2022 Compute a value weighted index for 15th January 2022 if the initial index value is 100. (5 marks) (b) b Beta Stock Green Berhad Purple Berhad Rit 12.2 9.0 Rmt 14.2 8.0 ai 0 0 1.7 1.1 Rit = return for stock i during period t Rmt = return for the aggregate market during period t Refer to above exhibit. What is the abnormal rate of return for stock Green Berhad during period t using only the aggregate market return (ignore differential systematic risk) and the abnormal rate of return for stock Purple Berhad when you consider its systematic risk measure (beta)? (5 marks) (e) Discuss any two (2) sell disciplines that a good investor should practice. You may discuss these sell disciplines either from fundamental analysis or technical analysis chart perspective or the combination of both perspectives. (10 marks) (Total: 20 marks) Question 3 (a) Use the information for below question. Stock Price (RM) Number of Shares Outstanding Y 2000 2000 2000 2000 z 1000* 2000 2000 2000 X Y Z Jan. 13, 2022 20 40 30 1000 Jan. 14, 2022 25 42 18 1000 Jan 15, 2022 27 45 8 1000** Jan. 16, 2022 20 40 10 3000 *2:1 Split on Stock Z after Close on Jan. 13, 2022 **3:1 Split on Stock X after Close on Jan. 15, 2022 Note: The base date for index calculations is January 13, 2022 Compute a value weighted index for 15th January 2022 if the initial index value is 100. (5 marks) (b) Stock Green Berhad Purple Berhad Rit 12.2 9.0 Rmt 14.2 8.0 OOP Beta 1.7 1.1 0 Rit - return for stock i during period t Rmt = return for the aggregate market during period t Refer to above exhibit. What is the abnormal rate of return for stock Green Berhad during period t using only the aggregate market return (ignore differential systematic risk) and the abnormal rate of return for stock Purple Berhad when you consider its systematic risk measure (beta)? (5 marks) (c) Discuss any two (2) sell disciplines that a good investor should practice. You may discuss these sell disciplines either from fundamental analysis or technical analysis chart perspective or the combination of both perspectives. (10 marks) (Total: 20 marks) Question 3 (a) Use the information for below question. Stock Price (RM) Number of Shares Outstanding Jan. 13, 2022 Jan. 14, 2022 Jan. 15, 2022 Jan. 16, 2022 X 20 25 27 20 Y 40 42 45 40 z 30 18 8 10 X 1000 1000 1000** 3000 Y 2000 2000 2000 2000 z 1000* 2000 2000 2000 *2:1 Split on Stock Z after Close on Jan. 13, 2022 **3:1 Split on Stock X after Close on Jan. 15, 2022 Note: The base date for index calculations is January 13, 2022 Compute a value weighted index for 15th January 2022 if the initial index value is 100. (5 marks) (b) b Beta Stock Green Berhad Purple Berhad Rit 12.2 9.0 Rmt 14.2 8.0 ai 0 0 1.7 1.1 Rit = return for stock i during period t Rmt = return for the aggregate market during period t Refer to above exhibit. What is the abnormal rate of return for stock Green Berhad during period t using only the aggregate market return (ignore differential systematic risk) and the abnormal rate of return for stock Purple Berhad when you consider its systematic risk measure (beta)? (5 marks) (e) Discuss any two (2) sell disciplines that a good investor should practice. You may discuss these sell disciplines either from fundamental analysis or technical analysis chart perspective or the combination of both perspectives. (10 marks) (Total: 20 marks)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts