Question: Question 3: Question 4: Question 5: QUESTION 3 Suppose that on March 31, 2017 firm XYZ announces its quarterly earnings as scheduled. Is the stock

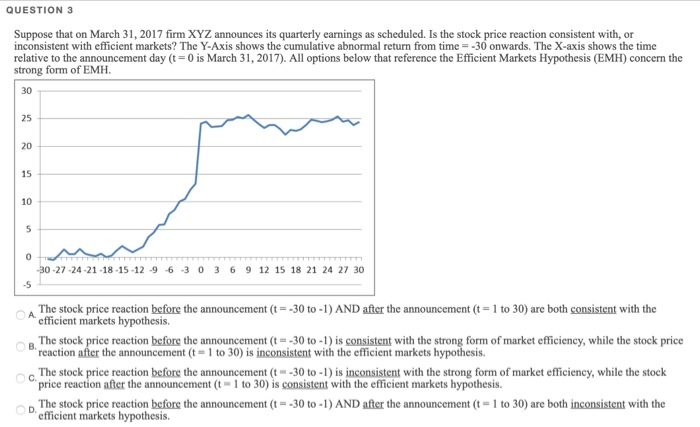

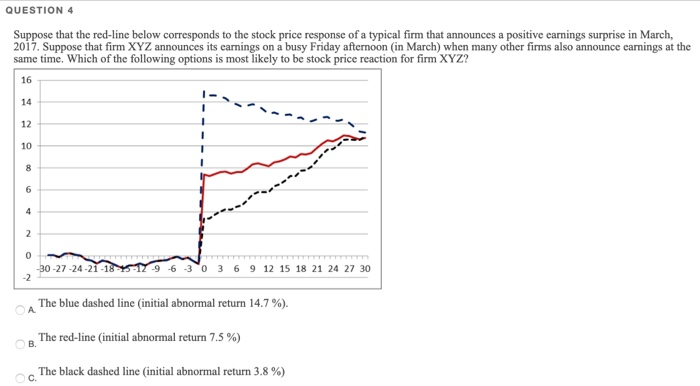

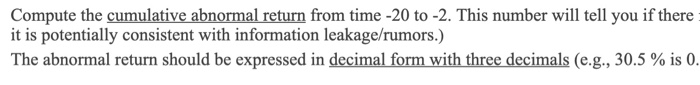

QUESTION 3 Suppose that on March 31, 2017 firm XYZ announces its quarterly earnings as scheduled. Is the stock price reaction consistent with, or inconsistent with efficient markets? The Y-Axis shows the cumulative abnormal return from time = -30 onwards. The X-axis shows the time relative to the announcement day (t=0 is March 31, 2017). All options below that reference the Efficient Markets Hypothesis (EMH) concern the strong form of EMH. -30-27-24-21-18-15-12 -9 6 3 0 3 6 9 12 15 18 21 24 27 30 . The stock price reaction before the announcement (t=-30 to -1) AND after the announcement (t-1 to 30) are both consistent with the efficient markets hypothesis. The stock price reaction before the announcement (t=-30 to -1) is consistent with the strong form of market efficiency, while the stock price reaction after the announcement (t = 1 to 30) is inconsistent with the efficient markets hypothesis. The stock price reaction before the announcement (t=-30 to -1) is inconsistent with the strong form of market efficiency, while the stock price reaction after the announcement (t-1 to 30) is consistent with the efficient markets hypothesis. The stock price reaction before the announcement (t--30 to -1) AND after the announcement (t-1 to 30) are both inconsistent with the efficient markets hypothesis. QUESTION 4 Suppose that the red-line below corresponds to the stock price response of a typical firm that announces a positive earnings surprise in March, 2017. Suppose that firm XYZ announces its earnings on a busy Friday afternoon in March) when many other firms also announce earnings at the same time. Which of the following options is most likely to be stock price reaction for firm XYZ? -30-27-24-21-185 -17-9 -6 3 0 3 6 9 12 15 18 21 24 27 30 The blue dashed line (initial abnormal return 14.7%). B. The red-line initial abnormal return 7.5 %) The black dashed line initial abnormal return 3.8 %) Compute the cumulative abnormal return from time -20 to -2. This number will tell you if there it is potentially consistent with information leakage/rumors.) The abnormal return should be expressed in decimal form with three decimals (e.g., 30.5 % is 0

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts