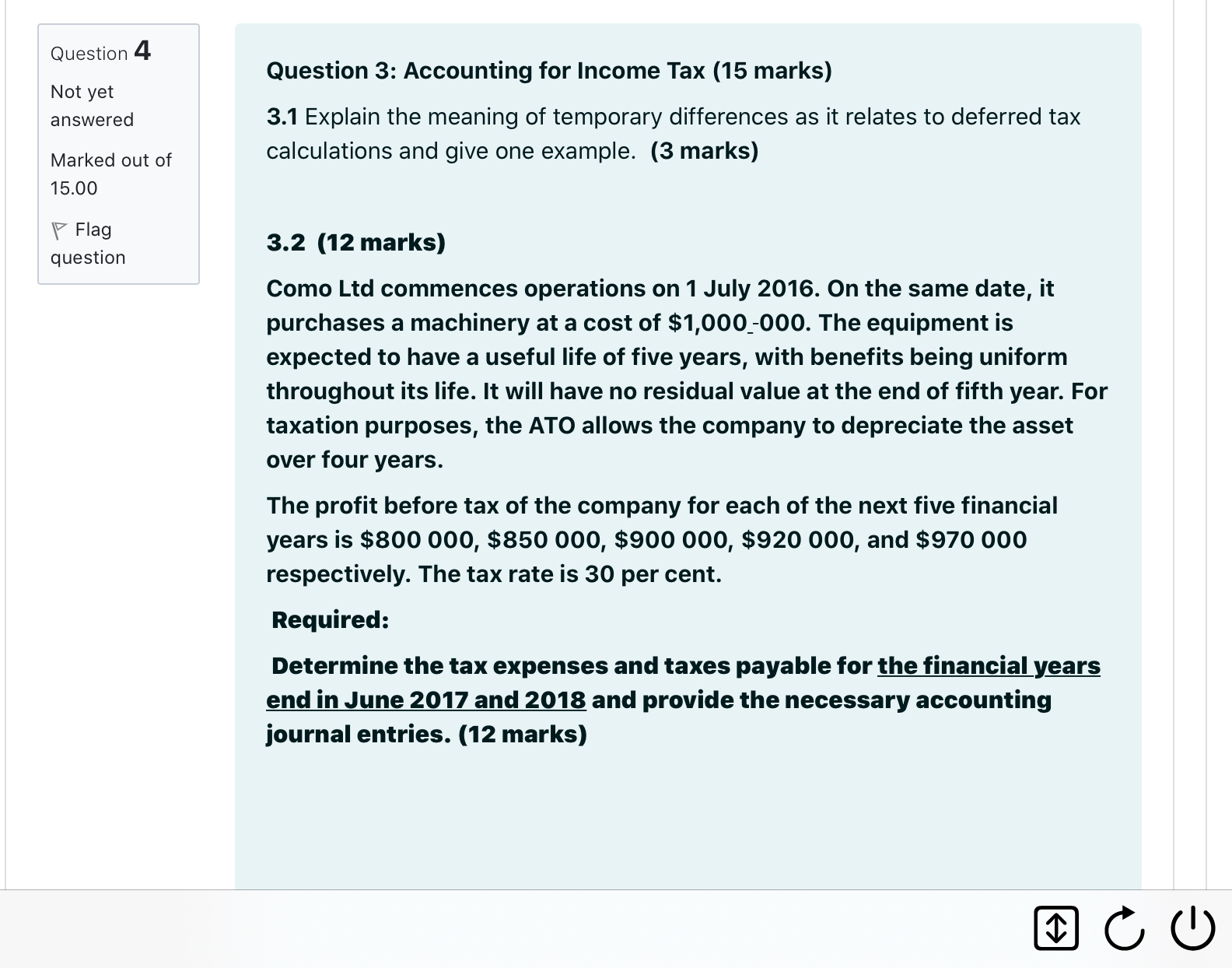

Question: Question 3 Question 4 . _ Questlon 3: Accounting for Income Tax (15 marks) Not yet answered 3.1 Explain the meaning of temporary differences as

Question 3

Question 4 . _ Questlon 3: Accounting for Income Tax (15 marks) Not yet answered 3.1 Explain the meaning of temporary differences as it relates to deferred tax Marked out of calculations and give one example. (3 marks) 15.00 Fl '7 a? 3.2 (12 marks) question Como Ltd commences operations on 1 July 2016. On the same date, it purchases a machinery at a cost of $1,000_000. The equipment is expected to have a useful life of five years, with benefits being uniform throughout its life. It will have no residual value at the end of fifth year. For taxation purposes, the ATO allows the company to depreciate the asset over four years. The profit before tax of the company for each of the next five financial years is $800 000, $850 000, $900 000, $920 000, and $970 000 respectively. The tax rate is 30 per cent. Required: Determine the tax expenses and taxes payable for the financial years end in June 2017 and 2018 and provide the necessary accounting journal entries. (12 marks) ICC)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts