Question: question 3 Question Completion Status: QUESTION 3 Rico has one share of stock and one bond issued by the Island Adventure Company. The total value

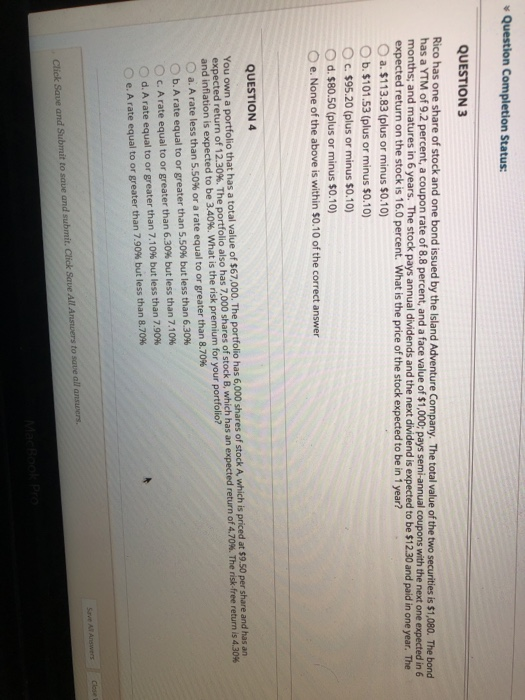

Question Completion Status: QUESTION 3 Rico has one share of stock and one bond issued by the Island Adventure Company. The total value of the two securities is $1,080. The bond has a YTM of 9.2 percent, a coupon rate of 8.8 percent, and a face value of $1,000; pays semi-annual coupons with the next one expected in 6 months; and matures in 6 years. The stock pays annual dividends and the next dividend is expected to be $12.30 and paid in one year. The expected return on the stock is 16.0 percent. What is the price of the stock expected to be in 1 year? a. $113.83 (plus or minus $0.10) O b.$101.53 (plus or minus $0.10) OC. $95.20 (plus or minus $0.10) d. $80.50 (plus or minus $0.10) e. None of the above is within $0.10 of the correct answer QUESTION 4 You own a portfolio that has a total value of $67,000. The portfolio has 6,000 shares of stock A, which is priced at $9.50 per share and has an expected return of 12.30%. The portfolio also has 7,000 shares of stock B, which has an expected return of 4.70%. The risk-free return is 4.30% and inflation is expected to be 3.40%. What is the risk premium for your portfolio? a. A rate less than 5.50% or a rate equal to or greater than 8.70% b. A rate equal to or greater than 5.50% but less than 6.30% c. A rate equal to or greater than 6.30% but less than 7.10% d. A rate equal to or greater than 7.10% but less than 7.90% e. A rate equal to or greater than 7.90% but less than 8.70% Save Al Answers Click Save and Submit to save and submit. Click Save All Ansters to save all are

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts