Question: Question 3 Ravi, a fund manager working for a private equity firm headquartered in Singapore, is considering including the following stocks in the firms portfolio:

Question 3 Ravi, a fund manager working for a private equity firm headquartered in Singapore, is considering including the following stocks in the firms portfolio:

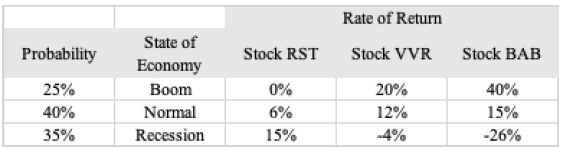

He plans to invest 40% of the portfolio funds in stock RST and the balance equally between VVR and BAB. Beta of stock VVR is 0.15 higher than RST. The firms in-house economist anticipates the probability of boom, normal and recession to be 25%, 40% and 35% respectively. The yield on long term government securities is 3% per year.

He plans to invest 40% of the portfolio funds in stock RST and the balance equally between VVR and BAB. Beta of stock VVR is 0.15 higher than RST. The firms in-house economist anticipates the probability of boom, normal and recession to be 25%, 40% and 35% respectively. The yield on long term government securities is 3% per year.

Question

Compute the expected market risk premium assuming capital asset pricing model holds.

Rate of Return State of Economy Boom Normal Recession Stock VVR Stock BAB Probability 25% 40% 35% Stock RST 0% 6% 15% 20% 12% -4% 40% 15% -26%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts