Question: Question 3. Required (a) Graphical representation, regression analysis and common-size analysis represent a range of different tools available to a financial statement analyst. Briefly discuss

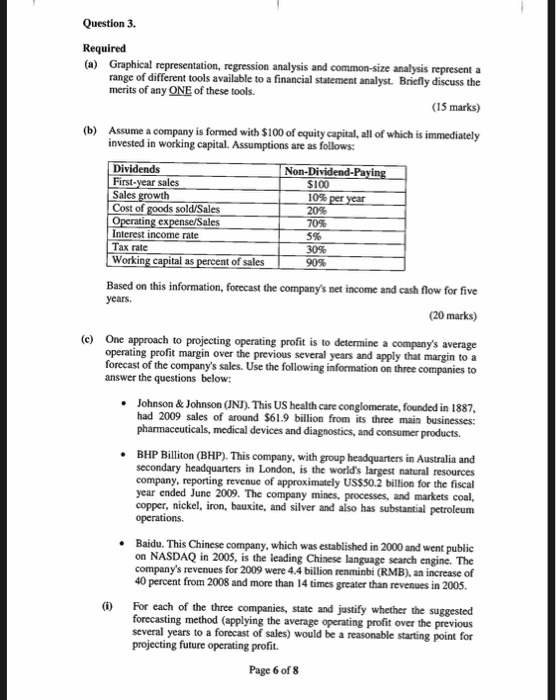

Question 3. Required (a) Graphical representation, regression analysis and common-size analysis represent a range of different tools available to a financial statement analyst. Briefly discuss the merits of any ONE of these tools. (15 marks) (b) Assume a company is formed with $100 of equity capital, all of which is immediately invested in working capital. Assumptions are as follows: Dividends First-year sales Sales growth Cost of goods sold/Sales Operating expense/Sales Interest income rate Tax rate Working capital as percent of sales Non-Dividend-Paying $100 10% per year 209 70% 54 309 90% Based on this information, forecast the company's net income and cash flow for five years (20 marks) (c) One approach to projecting operating profit is to determine a company's average operating profit margin over the previous several years and apply that margin to a forecast of the company's sales. Use the following information on three companies to answer the questions below: Johnson & Johnson (JNJ). This US health care conglomerate, founded in 1887, had 2009 sales of around $61.9 billion from its three main businesses: pharmaceuticals, medical devices and diagnostics, and consumer products. BHP Billiton (BHP). This company, with group headquarters in Australia and secondary headquarters in London, is the world's largest natural resources company reporting revenue of approximately US$50.2 billion for the fiscal year ended June 2009. The company mines, processes, and markets coal, copper, nickel, iron, bauxite, and silver and also has substantial petroleum operations. Baidu. This Chinese company, which was established in 2000 and went public on NASDAQ in 2005, is the leading Chinese language search engine. The company's revenues for 2009 were 4.4 billion renminbi (RMB). an increase of 40 percent from 2008 and more than 14 times greater than revenues in 2005. For each of the three companies, state and justify whether the suggested forecasting method (applying the average operating profit over the previous several years to a forecast of sales) would be a reasonable starting point for projecting future operating profit. Page 6 of 8 Question 3. Required (a) Graphical representation, regression analysis and common-size analysis represent a range of different tools available to a financial statement analyst. Briefly discuss the merits of any ONE of these tools. (15 marks) (b) Assume a company is formed with $100 of equity capital, all of which is immediately invested in working capital. Assumptions are as follows: Dividends First-year sales Sales growth Cost of goods sold/Sales Operating expense/Sales Interest income rate Tax rate Working capital as percent of sales Non-Dividend-Paying $100 10% per year 209 70% 54 309 90% Based on this information, forecast the company's net income and cash flow for five years (20 marks) (c) One approach to projecting operating profit is to determine a company's average operating profit margin over the previous several years and apply that margin to a forecast of the company's sales. Use the following information on three companies to answer the questions below: Johnson & Johnson (JNJ). This US health care conglomerate, founded in 1887, had 2009 sales of around $61.9 billion from its three main businesses: pharmaceuticals, medical devices and diagnostics, and consumer products. BHP Billiton (BHP). This company, with group headquarters in Australia and secondary headquarters in London, is the world's largest natural resources company reporting revenue of approximately US$50.2 billion for the fiscal year ended June 2009. The company mines, processes, and markets coal, copper, nickel, iron, bauxite, and silver and also has substantial petroleum operations. Baidu. This Chinese company, which was established in 2000 and went public on NASDAQ in 2005, is the leading Chinese language search engine. The company's revenues for 2009 were 4.4 billion renminbi (RMB). an increase of 40 percent from 2008 and more than 14 times greater than revenues in 2005. For each of the three companies, state and justify whether the suggested forecasting method (applying the average operating profit over the previous several years to a forecast of sales) would be a reasonable starting point for projecting future operating profit. Page 6 of 8

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts